|

CtC Victory Highlights THE FOLLOWING VICTORIES ARE SELECTED FOR SPECIAL NOTICE FROM AMONG THE HUNDREDS OF THOUSANDS OF SUCCESSFUL APPLICATIONS OF THE LAW BY CtC-EDUCATED AMERICANS DUE TO THE OBVIOUS DEGREE OF LIVE TAX AGENCY ATTENTION WHICH THEY RECEIVED, AND/OR FOR OTHER CHARACTERISTICS WHICH WILL BE SELF-EVIDENT. BE SURE TO CLICK ON ANY LINKS TO ASSOCIATED DOCUMENTS WHEN THEY ARE PROVIDED!

I draw special attention to these victories because they make particularly clear that CtC-educated victories are NOT computer glitches, oversights, slippings-through-cracks, etc., as those who seek to thwart the spread of CtC-provided knowledge about the truth of the tax often try to suggest.

Of course, reading CtC will, by itself, make the truth about the law and the tax clear to anyone, by its comprehensive presentation of the relevant statutes, the details of the tax structure, the Constitutional provisions on which both are based, and the relevant jurisprudence on the subject over the 150 years during with this tax has been with us. But seeing that truth in action puts a nice icing on that cake!

(To see more victories by CtC-educated Americans which are especially notable due to considerable tax agency interaction-- and case studies of tax-agency efforts to evade the truth about the tax-- visit the 'Every Which Way But Loose' page...)

Audrey Thompson

A. M.

The background:

The victory:

Justin _

See the background and related docs on this victory here.

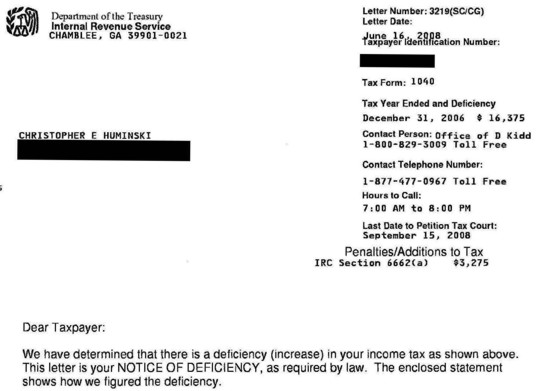

Chris Huminski

Chris got this in February:

He responded with this:

Chris included a strongly worded letter making clear that he was standing by the testimony on his filed 1040 and his 1099 rebuttal (copies of which were attached):

Nonetheless, the IRS proceeded to issue this:

Chris made an irate phone call to the tax agency, and afterward sent me the following email:

And so they did...

K. T.

Click here to see the filing, the IRS attempt to disregard it and extract more than $43,000.00, and the response leading to the notice above.

William Barnes

(This is a composite of three separate pages.)

Bill had inadvertently failed to claim his personal exemption on his return-- the IRS helpfully applied it and reduced Bill's tax accordingly. Click here to see the relevant docs.

Joseph C.

This latest victory for Joseph met with a little resistance at first. Get the details here.

Enjoy Joseph's 2005 Illinois victory here, and his federal victories for 2005 and 2006 here and here.

Alisha Ritz

Who received this (after having already filing an amended return regarding this year):

...responded with a demand that her return be processed and for proof of assessment by way of this,

...resulting in this:

this (which Alisha is now engaged in disputing):

and this:

*** On a separate front, Alisha also secured THIS victory this summer:

This puts me in mind of those get-the-school-year-rolling writing assignments we all remember so fondly (or not): "Write two pages on what you did during summer vacation." Alisha's (like that of all CtC Warriors) would start out with, "I spent the summer upholding the rule of law..."

It wasn't just a summer project, though:

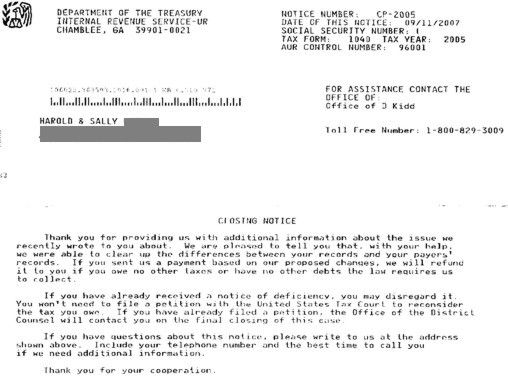

Hal and Sally _

The docs concerning the IRS dispute with Hal and Sally over some $193,000 in earnings, which ended with this closing notice, can be seen here.

Rick S.

Click here to see the docs associated with this federal refund for 2006, including an IRS notice that it had been subjected to special scrutiny prior to issuance.

Mark _

Click here to see the docs associated with this $122,435.00 retention

Jon G.

This first check is a partial, because, as Jon reports with chagrin, "I screwed up with my tax software and didn't overwrite all the necessary fields on the 1040 to include my FICA and Medicare payments in the amount of tax paid. Needless to say, my buddies at the IRS changed my requested refund to the lower amount - that of my entire Federal tax withheld. C'est la vie... I guess I have to file a 1040x to recover the remainder."

Jon did just that...

"Pete, as requested, here is the scan of the rest of my property. I had originally sent a letter telling them that they had made a mistake and the FICA and Medicare should have been included in amounts returned. I got back a nice letter from them, politely telling me that FICA and Medicare were not included in Federal taxes, or allowed to be refunded, as they go into the retirement account to pay social security.

However, they were kind enough to also include a 1040X without saying why, so I duly filed it correcting my original error and their correction, and received the check and the letter stating: "As you requested, we changed your account for 2005 to correct your total federal income tax withheld."

Hmmmm... I guess we now know which it actually is.

Best, Jon"

Jerry and Becky Cope

Click here to see the docs leading to this IRS abandonment of a proposed $3,268.00 tax liability.

John N_

has also transformed a "proposed $6,738.00 change to your tax" into:

by means of this and his return.

Kurt Rowe

Kurt got word March 14th from "his" credit union that it intended to turn over his money to another party (the IRS) in response to nothing more than a slip of paper alleging a tax debt for 2001. Kurt immediately called the IRS and informed the agent responsible that he had recently filed a 1040 for that year, and there was no debt. The agent asked Kurt to fax a copy of the return, which he did. After looking over Kurt's educated filing, the agent immediately released the levy.

Click on the links in the summary above to see the other docs involved.

(I hope that all those who pull their business from the credit union involved in this little affair go to the trouble of explaining why they are doing so to the management. It'd be good for the cause...)

Click here to see Kurt's 2004 federal refund, and here to enjoy his 2006 refund.

Pitman Buck

CtC Warrior Pitman Buck, who recently received a "CP2000" notice by which the IRS proposed he owed a tax because:

has transformed the situation to:

by simply re-iterating clearly to the balky 'service' that he didn't engage in any federally-connected activities during 2004-- instead, his earnings were all private-sector only, and he really meant it when he rebutted the erroneous "information returns" to the contrary issued by those who had paid him during that year by way of his filing.

Needless to say, no one should have to waste paper, stamps, and time repeating themselves, just because the beneficiaries of ignorance about the "income" tax don't want to face the facts, and harbor misplaced optimism about being able to intimidate those who know the truth into retreating into servility. Still, all's well that ends well, and I suppose that in light of the past decades of success the tax agencies have enjoyed in exploiting ignorance, an occasional reflexive resort to past bad practices is to be understood (even if not forgiven)... The docs excerpted above, and Pitman's re-iteration of the facts, can be enjoyed here.

Robert J. _

The docs associated with this refund, which are particularly worthy of note, can be seen here.

Marcianne _

Click here to see the docs associated with this refund

David Gute

David filed this return...

...and promptly got this response:

He replied with this:

...resulting in this very courteous finale, some 40 days later:

David thoughtfully went to the trouble of furnishing, for the edification of his fellow Americans, what he WOULD have filed, had he not learned the truth about the law.

B. Green

Jerry and Alicia Bedgood

Adrian Outridge

Click here to see the docs associated with this refund

Jessica _

Click here to see the docs submitted to claim this refund

John T.

John had been a non-filer for years. The IRS, acting on the basis of thus-unchallenged "information return" testimony, had calculated a tax for John for 2002, and had simultaneously asked two different parties in possession of property belonging to John for the total amount calculated. Each of these parties, not knowing about the other, complied with the request; each turned over more than $7000.00 of John's property to the government. Then, John got educated and filed a return containing HIS testimony. Without a further word, John received notification that he owed no tax, his alleged liability was zeroed out, and all penalties and interest were canceled-- and two checks refunding all of his seized property.

Kadybeth Thompson

See the docs associated with this refund here.

Andrew Lewis

Pennsylvania argued with Andrew about this claim at first. Click here to see the state's dispute and Andrew's reply.

Andrew's 2006 federal victory can be seen here.

Andrew and Kecia Smith

Click here to see the documents associated with this refund, including the notice by the state of Kansas informing the Smith's that they had claimed less money than was due them, and that the state had increased their refund accordingly.

Steve _

This is a complete refund of what had been given to the federal government for "income" taxes during 2004-- which had been sent in by Steve himself with his automatic extension request. Subsequently, Steve learned the truth about the law and filed accordingly...

...and then the IRS argued with him-- briefly-- as indicated here...

...leading to this:

Bob Gross

'Cracking the Code-...' warrior Bob Gross opened his mail a few weeks ago and found the most pleasant notice he had ever gotten from the IRS: A "Case Closed" for the 'deficiency' the 'service' had asserted against him for 2003. Bob had filed a 'Schiff-style' "zero" return, had subsequently been being threatened with a levy over what the 'service' claimed he owed for that year and had argued the matter for some time without success. Just after the IRS issued him a formal 'Notice of Deficiency', Bob learned the truth about the law and finally, for the first time, addressed the '1099' evidence on which the calculation of the 'deficiency' was based. The result?

See the other docs associated with this victory for the rule of law here.

Richard Hart

Richard calculates that if he had left the 1099 for 2004 unrebutted, he would have been presumed to owe $4200 in "income" tax for the year.

The $208 is precisely the (rounded) amount of interest paid to Richard with the complete refunds for 2002 and 2003 that he secured last year-- and the only portion of his total receipts for 2005 which qualified as "income" according to both Richard and the IRS. The docs Richard filed for 2005 can be seen here.

Paulette Thompson

From this...

To this...

Click here to see the documents related to this 2004 refund

Michael and Janice Bernard

This is not a standard refund-- click here for the story...

Bryan Hibben

The documents Bryan filed related to this refund can be seen here...

...and those related to this one, which involved an effort by Illinois to thwart Bryan's claim, can be seen here.

To see more victories by CtC-educated Americans which are especially notable due to considerable tax agency interaction-- and in one case, a significant Tax Court victory-- visit the 'Every Which Way But Loose' page.

Click here for links to hundreds more posted victories

Despite the fact that those whose victories are on display here did nothing but insist that the law be applied as it is written, they did so in the face of fearful threats and cunning disinformation from the beneficiaries of corruption. Their actions took great courage and commitment, and I salute them all.

“God grants liberty only to those who love it, and are always ready to guard and defend it.”

-Daniel Webster

NOTE: Whether any given individual is entitled to a refund depends on a number of different factors, and no one should presume that they are so entitled simply because they see that others are. Each person should educate himself or herself about the particulars of the law, and make his or her own determination in this regard.

NOTE: The documents displayed on this and any linked pages, and any associated comments, are posted with the permission and cooperation of the upstanding Americans with whom they are concerned.

When a return is posted in connection with any refund or other responsive document, it is complete-- that is, what is posted is EVERYTHING filed as a return in connection with that refund or document, unless otherwise indicated. |