|

The liberating truth about the "income" tax is turning those

who would evade it

Every Which Way But Loose

A collection of undeniable evidence of the

correctness of

CtC

Do you remember those old sci-fi movies (and numerous 'Lost in

Space' and 'Star Trek' episodes) in which an evil robot or a

computer collapses into terminal dysfunction after being

presented with data that "does not compute"? The machine

would flail about dangerously for a bit (or smoke and shake, and

threaten to explode) before finally going limp, silent and

harmless.

"LOOK OUT, DOCTOR SMITH!! DANGER!! WARNING!!"

Some

CtC Warriors are being drafted to play the part of the

intrepid heroes of these space operas lately, with federal and

state "income" tax agencies in the role of the neurotic robot.

SINCE AUGUST OF 2003, when the revelations of

CtC were first published,

tens of thousands

of readers of 'Cracking

the Code- The Fascinating Truth About Taxation In America' have taken

control of their own resources, in accordance with, and respect for, the

law. The total amount reclaimed by these good Americans so far is

upward of several billion dollars.

During the same period,

the IRS has engaged in a

desperate struggle to regain its hold of fear and confusion over

those now equipped with an understanding of the long-hidden

secrets of the "income" tax, and to stop that understanding from

spreading. This effort has involved the resort to many (and

increasingly) bizarre evasions and theatrics.

IN THIS SERIES, we take a close look at many of these gimmicks,

ploys and dodges. The action in these episodes will range from silly

one-shot, quickly-abandoned agency stalls to drawn-out, elaborate

efforts to resist or evade or discourage

CtC-educated filers ending in dramatic slap-downs of the

law-defying tax agency.

One consistent feature of all of these episodes is

the special clarity with which they illustrate the accuracy and

completeness of what

CtC reveals about the "income" tax. Unlike the vast majority

of

CtC-educated refunds and other victories in applying the

law in which the

deep vetting to which every claim is subject is done out of

view, with no evidence of the process except the filing and the

check or transcript, what happens in the cases highlighted in

this series takes place only after unambiguous, close tax-agency

attention to the claim.

Thus, these cases present a wake-up splash of

reality to those who struggle to persist in denial about the

truth, completeness and correctness of

CtC (some of whom actually argue with a straight face that

the hundreds of thousands of complete refunds issued over all

those years now from the feds and more than three dozen state

and local tax agencies are a sustained "slip through a crack"!).

Here it is in a word:

NOT ONE OF THE

SURRENDERS DOCUMENTED IN THIS SERIES WOULD OR COULD HAPPEN

UNLESS THE FILINGS AND CLAIMS MADE WERE CORRECT AND PROPER UNDER

THE LAW. NOT

ONE. Each of the victories

presented here took place with the knowledge and participation

of tax agency personnel. In almost every case, those victories

took place over and despite the outright resistance of those

officials.

Similarly, NOT ONE of the contortions and evasions

documented in this series would be attempted unless the filings

and claim against which they are deployed is correct and proper

under the law. It is the insurmountably correct character of

these educated filings that compels the tax agencies to resort

to smoke, mirrors and bluster.

Because these things DID and DO happen, the correctness of

CtC-educated filings and claims, and the view of the law on

which they are based, is indisputable.

Enjoy.

|

Ben Pezzano's

Slap-Down Of Opportunistic IRS Mendacity

BEN FILED NOT ONLY an educated return

and claim concerning 2022 withholding totaling

$7,884.03 early this year (albeit with a little

confusion over

the proper way to rebut an erroneous K-1). He

also provided a very clear cover letter explaining

his filing. (See

both here.)

Nonetheless, the first response by the

IRS was to try its ridiculous and corrupt pretense

of acknowledging that Ben had had no tax-relevant

"income" and owed no tax, but was somehow entitled

to keep what had been withheld from him as Social

Security and Medicare taxes (by pretending that

those amounts had not been withheld, or don't

qualify as "federal income taxes", and falsely

reporting the amount shown on line 25(d) of Ben's

1040 to be only $2,493 (just as discussed more fully

here in regard to the same corrupt treatment

visited upon Lance Cole):

Immediately upon receiving the partial

refund pretense, Ben, drawing on the comprehensive legal

resources I have presented in

my books

and on

LHC

over the last 20 years, fired off

this cogent and concise reply, spelling out the

relevant law and facts in detail, and demanding

proper treatment by the tax agency. The IRS

responded with a bizarre, disconnected letter about

an amended return,

seen here. Again, Ben fired off a

straightforward and sensible reply pointing out

the relevant facts and making clear that he was a

grown-up American fully committed to standing his

ground and enforcing the law.

After these exchanges helped the IRS

see the light, the agency finally threw in the towel

and got right with the law, returning all of Ben's

money, with interest:

WELL DONE, Ben!

|

|

Ruben of California's Christmas

Carol

IN MARCH OF 2021, the excellent Ruben of

California was minding his own business like every good

American should when there appeared before him an

unexpected sight. It was a ghost of Christmases past--

the spittle-flecked, chain-rattling specter of a

junk-yard dog whose tag bore the cryptic runes: IRS.

Ruben remembered well the years gone by in

which the sight of this crooked and mangy beast had

struck fear into his heart.

This time, however, even though in its

yellowed and carious fangs the grim and grimy cur

clutched a paper titled "Notice of Deficiency":

...by which it was alleged that

contrary to his own testimony of having received $0 in

"income" during 2017, Ruben

had actually received more than $61K in "income" that

year and owed $8,633.00 in tax, Ruben just smiled

and muttered, "Game on."

Not quite a year-and-a-half later, a new

vision had appeared. This time Ruben was visited by a

right jolly old elf, laden with gifts. The government

effort to scam thousands of dollars from Ruben to which

it had no claim collapsed into an admission that no

deficiency existed, yielding an October, 2022 Tax Court

ruling in Ruben's favor, just in time to brighten the

upcoming holidays:

Merry Christmas, Ruben!!

ONE IMPORTANT CLARIFICATION needs to be

made so no one is misled by the "nor overpayment due to"

portion of the ruling above. Ruben has already

received the overpayment he had claimed in

the filing involved:

As seen, the refund had been diverted as a

credit against an alleged balance owed for another year,

which Ruben disputes. In addition to petitioning for the

voiding of the deficiency allegation, Ruben had asked

the court to order his "collected" overpayment converted

to a check.

The government had argued in response that

recovery of that already-refunded-but-diverted

overpayment had to be by a legal action specifically

addressing the prior year "balance due" allegation,

which was not relevant to the notice of deficiency at

issue in the instant case (and which therefore would not

be within the Tax Court's jurisdiction in this case). In

conference with the government's attorney upon

announcing its intention to surrender its deficiency

claim, Ruben recognized the merits of that argument and

agreed to take the overpayment issue off the table on

which it never really belonged in the first place.

OF MATERIALS IN THE CASE, I think those of

broadest interest and usefulness to this audience are

Ruben's Petition (find

it here); his January 10, 2022 Motion for Default

and Entry of Decision in Petitioner's Favor, and Motion

to Order Refund of Amount Collected (find

it here); and his April 5, 2022 Declaration of Facts

(in the end never filed, but informative, nonetheless--

find it here). Exhibits to these pleadings have been

omitted, but their nature and contents are specified in

the citing documents.

|

|

Piotr and

Stephanie Bondaryk Face Down The Junk-Yard Dog

PIOTR AND STEPHANIE BONDARYK had to deal

with a bit of tedium over a spurious IRS "Notice of Deficiency"

alleging a big tax and penalties liability concerning 2017. As will be

seen, when Pitor and Stephanie confidently and resolutely stood their

ground, the bogus allegations melted away.

The story began when the Bondaryks received this CP2000

"Proposed Changes" notice alleging shortfalls in their 2017 return--

which had already been accepted, processed, and refunded in full (as

can be seen on this page):

Piotr and Stephanie responded within a few

weeks with this

pointed refusal to play along. The IRS then sent a

"we need time to

think about what to do now" letter.

The delay letter was followed, a bit past

the 60 days for which the agency had asked, with

another letter.

This one declared that "the information we have received

was not sufficient for us to change our determination

[on the basis of which the "change" proposal had been

made]", and went on to tell Piotr and Stephanie to

expect a "Statutory Notice of Deficiency" within 3 or 4

weeks. 11 days later, that notice arrived:

Confident in their

CtC-educated knowledge of the tax and the law-- and

resolute in their respect for the latter, even in the

face of its "official" enemies-- on April 15, 2020,

Piotr and Stephanie

again expressed their dispute with the now

more-formalized false allegations of liabilities by

which the IRS hoped to reverse its original and

inconvenient loss of revenue to the couple's proper

claim of refund.

Months went by, until August 20 of 2020,

when the IRS sent its

next letter. This one acknowledged receipt of the

Bondaryk's last response to the paper assault, warned

them that the now-long-since expired deadline for

petitioning Tax Court was not extended by their

response, and told the couple that the agency needed

another 60 days to ruminate on its conundrum of having

targeted its nonsense at well-educated real Americans

who simply would not back down.

Piotr and Stephanie promptly slapped the

agency sharply, with

this. Two months later the IRS replied-- but not to

Piotr and Stephanie's most recent broadside.

This latest agency

letter purported to reply once again to the April 15

response Piotr and Stephanie had made to the "Notice of

Deficiency", but this time specifically challenging the

rebuttal of a payor's "wage" allegations which is

included in the couple's return.

Piotr and Stephanie replied to that

challenge of their "wage" rebuttal on February 3, 2021,

with this specific

restatement/clarification of their return testimony.

The next thing to arrive from the IRS was a double-down

on the scare notices:

However... when a few more months had gone

by WITHOUT "payment [being] received immediately", the

tax agency threw in the towel. On June 10, 2021, it sent

this letter

acknowledging Piotr and Stephanie's February 3 response

and saying, "we need 90 days" to "process all your

information". About 9 weeks later came this surrender

notice:

Here is an

account transcript from the agency reporting

more-or-less all of this sordid little story.

CONGRATULATIONS to Piotr and Stephanie!

They've stood tall for the rule of law, in the snarling

face of a junk-yard dog.

|

|

Dane La Vigne's Demonstration

DANE LA VIGNE has secured a great victory concerning his $230,000 or so in earnings

during 2014. To begin with, the IRS initially admitted Dane's earnings were not

"income" (in the sense of being income tax relevant). The agency had dutifully

refunded the $1,000 deposit Dane had sent in with his application for a filing

date extension in April of 2015 and then reclaimed on

his return filed later

that year. It was thus (and properly) agreed that Dane's earnings were not of the specialized

variety received for the performance of taxable activities, and by which a

resulting tax liability could be measured.

But in 2016, some bad apple at the IRS decided to pretend the

agency had made a big mistake and try to herd Dane back into a copper-top pod.

The campaign began with this:

...to which Dane responded with

this, the following

October.

Meantime, a "proposed change" notice was run up the

flagpole:

It was hoped that Dane would be overawed by this "official"

expression, abandon his own knowledge of the provisions and particulars of the

relevant law, and salute the "proposal" like a good little soldier given orders

from above.

Not Dane. This man IS a good soldier-- but not the little kind who

worships at the altar of the state.

Dane is a good soldier of the Founders' republic. He is a big,

grown-up, real American man whose salutes are reserved for the principles of

liberty and the rule of law.

Dane stood his ground and stuck to what he himself had learned to

be true, by his own study and verification and reliance on his God-given powers

of reason. After three long years of increasingly strident harassment and

repeated officious pronouncements, including, among much else back and forth,

this:

...this:

...this:

...this:

(to which Dane responded months later with a FOIA request for

documents related to these purported assessments, and for which he received

this

in reply)

...this:

...this:

...this:

...and this:

...the IRS bluff, trickery and intimidation project collapsed in

September, 2019, ending with these

two flat-out white-flag acknowledgements:

It was a long pain-in-the-ass for Dane, but a capital victory in the end.

Perseverance won this battle, as it does every battle with adversaries whose

only weapons against solid,

well-grounded and accurate knowledge of the law are fear and bluster.

Dane is still waiting for the other shoe to drop on

the pretended "frivolous

return penalty", giving him a chance to demand a hearing and start that

nonsense on its way off-stage. Maybe that one will just ease off on its own

steam, under the circumstances...

Meantime, isn't it great that Dane has learned

the truth

about the tax?

Wouldn't it be

really great if

everyone did?

|

|

David H.'s Remarkable

2008 and 2010 Victories

(Docs are

linked throughout, either in the text or from

images):

ON APRIL 15, 2009, David H. filed a

perfectly normal

CtC-educated return. David is a

contractor, and has no withholdings to reclaim.

However, some of those paying David are ignorant of the true

character of the tax and/or of the purpose and

effect of "information returns". These folks produce

and submit "1099-MISCs" making tax-related

allegations about payments David receives, which

David is therefore compelled to rebut lest they be

taken as evidence of the conduct of taxable

activities and consequent liabilities for tax.

As can be seen in

David's return, he had several such 1099s to address

in regard to 2008. In each such case, David

testified that none of the payments he received from

the issuers of these forms actually related to any

taxable activity, and all told, he ends up with a

return reporting $0 "income" and nothing owing in

tax.

Nothing extraordinary here. But the

1099s David rebutted had alleged a total of more

than $280,000 worth of taxable activities during

2008.

In January of 2010 some bad apple at the IRS

going by the label "W. Brown" ("Wanda", as we are

later given to understand) decided to

try confusing, browbeating or intimidating David

into reversing himself. Ms. Brown sent

David

a "CP2501", inviting him to agree that $280,916 of

his earnings were from taxable activities, upon

which the agency would calculate a tax for him and

send him a bill:

David

courteously declined.

NONETHELESS, THE UNUSUALLY PERSISTENT

MS. BROWN figured she might as well try again (after

all, she isn't spending her own money on these ventures...).

Brown's next effort took an unfriendly turn, as she

hunkered back into what really is more natural for junk-yard dogs--

growly threats. This time the proposal

included a tax calculation (of $82,666.00) plus

another $20,649 in penalties and interest, in the

form of a CP2000:

David

again responded as indicated by the IRS form

(and with attachments as indicated on the

certification of mailing).

Normally, even in a case in which the

tax agency goes so far as to take a flutter on a

"proposed change" ploy, once firmly slapped down,

that ends the matter. Many examples can be seen

throughout the

EWWBL and

Victory Highlights collections.

FOR SOME PERVERSE REASON, THOUGH, the

"Brown" bad apple handling David's case hadn't seen the

memo. On June 07, 2010, yet another CP2000

addressed to David over his 2008 filing disgraced

the U.S. Mail, with a slightly plumped interest

amount, but otherwise the same as the previous

version:

Unbelievable! But this persistence is

what makes this such a great story. Keep reading...

ONCE AGAIN OUR intrepid hero David

gave his sling a whirl (though doubtless with

some considerable impatience this time). But the

hungry "Brown" just wouldn't go away. Instead she

doubled-down (thus setting herself and her agency up for an even

bigger tumble) with a "LTR3219 (Notice of

Deficiency) on August 30, 2010:

Again David shot out

a response, with restraint now truly remarkable,

all things considered (and with, it must be said,

references to "assessments" and "levy" that are

unnecessary at this point, but considering the

incoherence of the bad apple's behavior, some

confusion can be forgiven).

This time, David's refusal to be

intimidated appears to have brought "Brown's"

incoherence to her attention, and set her back on

her

heels. The next thing sent out from whatever little

federal fortress "W. Brown" lurks in was

a stall request dated November 23, 2010,

more-or-less saying, "Thank you for your

correspondence... we need 60 days to figure out what

to try next... Sorry for any inconvenience...".

60 days passed, then another 60.

Finally, 137 days after the "we need 60 days"

notice, David received the results of all the work

"W. Brown" needed all that time to conduct-- a new

flutter based on a new pretense (which David's

handwritten note points out):

Though different in form, what we have

here is really just another version of the CP2000

"proposals" David had already gotten several times.

This is shown by the "If you agree with the

changes..." language, which goes on to provide

options for expressing disagreement, just as in the

other version of this proposal.

So, 137 days of effort had yielded...

just more of the same, with the rogue tax agent no

further along in either supporting or achieving her

goal of getting her hands on what is now alleged to

a $107,066.76 liability. It looks like even

bad-apple-Brown is very well aware that what she's

been trying to glom onto is not actually a

legitimate liability, doesn't it?

Needless to say, David had

a few things to say in response to this

same-old, same-old.

Two and a half months later, the IRS--

now represented by someone calling himself "Paul

Morgan" finally had

an answer for David:

"Thank you for your correspondence... we need 45

days to figure out what to try next... Sorry for any

inconvenience...".

NOW, THIS TIME IT REALLY WAS just about

45 days before the next thing arrived from the IRS

about David's 2008 filing. And this time, the now

unnamed actor at the agency doubled-down yet again.

The new notice is couched as a demand,

and pretends that the issue of David owing the

amount demanded was no longer a "proposal", but

should be imagined to be settled. (Which is, let's

remember, the IRS's whole meme, right? David earned

money, so he must owe a tax, right?! What were they

thinking of with all this "proposal" stuff

before...):

But... at the same time the agency

couldn't quite play it this way without a little

safety valve admission-- again, now, from "Wanda

Brown". On August 26, 11 days after Paul Morgan's

demand, Ms. Brown sends the, "if you disagree" part

of the package:

On September 19, another notice

arrives, this one a bold-face threat:

On September 22, 2011, David sent

his reply. As is seen, at this point David

appears to have lost patience, and does a little

"reading of the riot act" to the persistent

parasites who have now been harassing him for nearly

two years over a bogus claim their own consistent

actions prove even they don't consider legitimate.

ON NOVEMBER 8, 2011, the whole thing

descends into comedy. Suddenly David receives a

letter described as a "follow-up" to an earlier

letter purportedly sent to him more than two years

ago, on September 27, 2009:

And guess what? Here again we have that

"If you disagree" safety valve function, dropping

things back into "proposal" status...

DOUBTLESS THOROUGHLY SICK OF THE WHOLE

CHARADE BY NOW, David didn't even bother to reply

until April of the next year, now 2012. After the

lengthy cooling down period, David was again

restrained in

his reply (note: the date David gives to the

November 8, 2011 letter is misstated as being a 2012

date).

Taking its cue from David (but really

just because it was still simply struggling to think

of ways to keep its pestering alive), the IRS then

sat out for seven months, before sending another

threat letter (its usual go-to solution when its got

no actual legal cards in its hand...). This one

purported to be a

"Final Notice Of Intent To Levy" and notice of

David's right to a hearing (over what it now claims

to be a $127,318.78 liability).

On November 30,

David shoots out a response (now more

appropriately addressing the issues of "assessment"

and "levy").

And again the seasons change...

Seven more months go by, and then, on

June 7, 2013, David receives what purports to be a

reply to his "correspondence received June 05, 2012"

(a year earlier). No clue is given as to what this

mystery correspondence is supposed to have been, but

whatever it supposedly was,

the IRS says it was FRIVOLOUS!!! (which would be

a classic case of the pot calling the kettle black,

if David had ever actually done anything

frivolous...).

David didn't even bother to reply to

this nonsense about a fictitious "correspondence".

SO, FOLLOWING ALL THE FOREGOING, we

have three years of

silence from the agency about David's

purported liability for 2008, taking us to May of

2016-- more than 7 years after David's return was

filed. Suddenly, on May 16, 2016, David gets an

"Annual reminder of overdue taxes for 2008", now

alleging a $147,334.65 liability:

Can you imagine David's reaction? His

weary and disdainful sigh must have been audible

throughout his whole neighborhood.

Two weeks later, David

sent off a response to this latest nonsense,

this time getting right down into some legal

details. Apparently, whoever received David's answer

had to chew on it for awhile, because it wasn't

until September 23, some 113 days later, that David

received his reply, which was... wait for it...

a request for more time to respond.

That 30 days of additional time asked

for by the agency on September 23, 2016 has now

stretched to 479 (at the date of this posting,

January 15, 2018). I say put a fork into it.

WE ARE NOW MORE THAN 8 years since the

IRS

first began troubling David with a "proposal" to assert

taxable activities and a corresponding liability for

2008. We are almost 9 years since the filing of

David's return establishing the contrary.

Throughout, we have seen a vigorous,

sustained effort by the IRS to browbeat, confuse and

intimidate David into reversing himself and

authorizing the taking of his money. All without

success, and without a dime leaving David's hand.

I can't think of a more vivid

demonstration of the truth about the tax and about

the manner by which its misapplication is

accomplished when the target of the scamsters lacks

a

CtC education. Well done, David!

But, WATCH OUT FOR THAT ROBOT!! I THINK

IT'S GOING TO EXPLODE!!

***

BTW, THOSE WHO READ THROUGH all the

documents posted in the tale told above will have

noticed David referencing his 2010 filing in one of

his responses to the mounting nonsense about 2008.

That little sidebar event definitely merits a few

words as well, since it puts a nice accent on the

proper take-away from the 2008 farce.

Happily, 2010 was a simple affair of

which numerous examples can be found on the

EWWBL

pages and in the

Victory Highlights-- a "proposed

increase", quickly shut down with a simple "No".

Here is the filing, which was met 16 months

later, on August 13, 2012, with this:

David-- who the IRS was, remember,

vigorously harassing over his 2008 filing-- shot off

a simple one page response, with a "No!"

indicator on the IRS form, as instructed.

Approximately 90 days later, David got

his proper response and acknowledgement:

A pity the IRS didn't just face the

facts as readily in regard to David's 2008 filing.

Think of all the public resources that could have

been saved (and all the postage that David could

have saved).

And isn't it a pity that everyone hasn't done

like David has, and become

CtC-educated and

CtC-activated?

|

|

The $0 "Deficiency"

THOUGH THIS EPISODE HAS YET TO CONCLUDE, I can't help

but post it anyway, because it might be the most

ludicrous and obvious IRS evasion effort yet. What we have here is a

purported "Notice of Deficiency" concerning

an

educated filing which agrees with the filers (who will remain

anonymous for the moment) that no "income" was had, and no tax is,

or ever was, due. Yes, that's right, the alleged "deficiency" is $0:

This bizarre evasion attempt builds its berth in

crazy-land by proposing that the positive amount claimed for refund

is a "deficiency". It gets there by the unique and legally

unsupported treatment of the refund claim as a "negative tax due"

amount, with this offered as the explanation: "NOTE: A decrease to

refundable credit results in a tax increase."

Okaaay...And how do we get to the "decrease in

refundable credit"? Simple! By the equally lunatic contrivance of

arbitrarily "correcting" the withheld amount to $0.00:

This fraudulent "Hail, Mary" pretense is floated despite the fact

that the full amount claimed for refund is shown as having been withheld in the agency's own

internal records, as well as by the sworn declarations of both the payers and the

filers. This,

for instance is from the IRS Account transcript:

This is from the IRS Record transcript, as of the same

date (6-24-2018):

IRS W-2 records precisely match the withholding

amounts reported by the filers. See, for instance, this IRS transcript (also dated

6-24-18) of what was reported by the principle

earner's payer:

Match the IRS reported withholding amounts to the first

Form 4852 in

the

return file here. Transcripts of withheld amounts for the other

member of this filing couple correspond to the other three 4852

declarations just as exactly.

Plainly the IRS knows perfectly well that the

withholding reported by

the filers is exactly what WAS withheld, and

that the amounts are attested-to by the payers involved, as well.

This "notice of deficiency" bears every indication of a

truly desperate attempt by the IRS to simply confuse or

intimidate the good Americans whose claim the agency is

trying to evade.

ALL IN ALL, this latest jink by the federal tax

agency down the crooked path is a wonder to behold. Not

the good kind, but a wonder nonetheless.

It is also a very emphatic underscore of the

inescapable truth about the tax which this corrupt effort is meant

to evade. As said in the introduction to this collection: NOT ONE of

the contortions and evasions documented in this series would be

attempted unless the filings and claim against which they are

deployed is correct and proper under the law. It is the

insurmountably correct character of these educated filings that

compels the tax agencies to resort to smoke, mirrors and bluster.

But at the same time,

Watch out for that robot! I

think it's going to explode!!

|

|

George and Sheila Stand Up for the Law

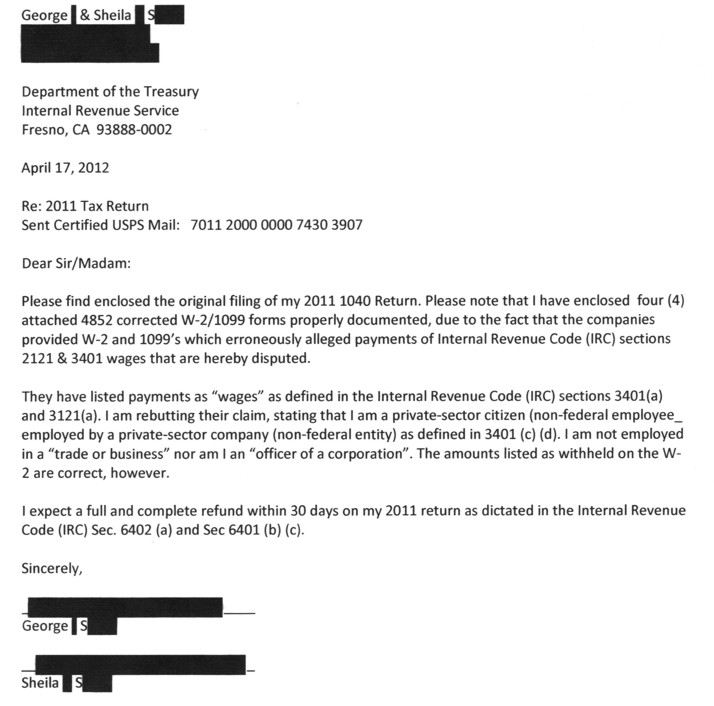

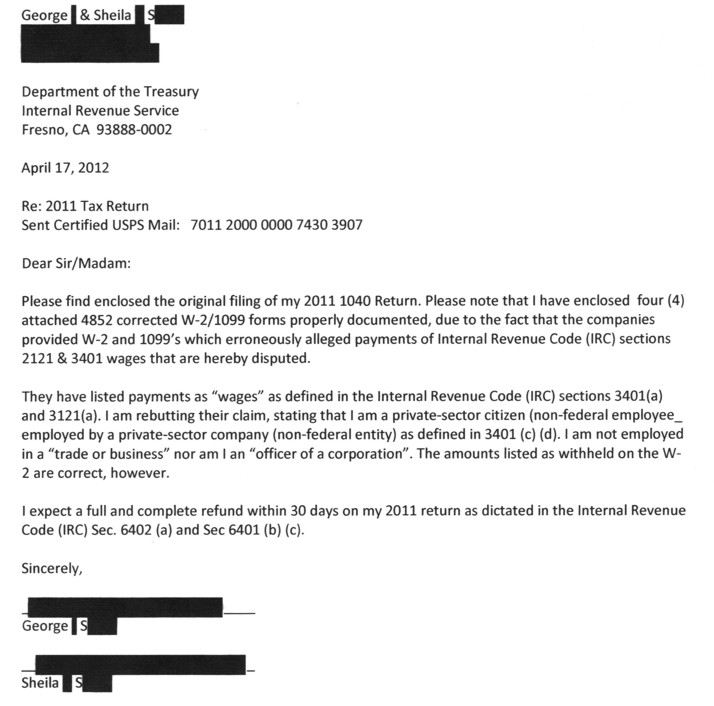

On April 17, 2012,

CtC-educated American grown-ups George and Sheila called

upon the United States to obey the law. George and Sheila

called on the feds to acknowledge that while the couple had

earned a fair chunk of money during 2010 and 2011, none of

it was through activity in which the feds had a stake, and

through which a federal claim to a portion thereof had

arisen.

Further, because the feds had no skin in their game and no

claim to its proceeds, the couple demanded the return of

every penny that had been held back by payers and advanced

to the United States during those years against the

possibility that George and Sheila might have discovered,

upon examining their records at the close of those years,

that they HAD done taxable things upon which a tax liability

HAD arisen.

George and Sheila went to pains to ensure that their claims

and declarations were crystal-clear. With each of their

testimonials and claims they included a cover letter

explaining their filings. Here, for instance is the one that

accompanied George and Sheila's 2011 1040 and rebuttal

instruments:

You can see the complete filing made for 2011

here. You'll note that the claim is for the return of

every penny withheld-- SS and Medicare taxes included-- a

total of $3,470.00. The filing George and Sheila submitted

concerning 2010 and involving two "Forms 4852", also for

every penny and this time totaling $5,029.00, can be seen

here.

About nine weeks later, just about the interval at the end

of which most

CtC-educated claimants

simply get their money back, the IRS instead dropped a

couple of speedbumps in front of George and Sheila. These

consisted of notices alleging that no 2008 filing had been

received from the couple, that the IRS was therefore

proposing an assessment of its own for that year totaling

more than $8,400.00, and that George and Sheila's 2010 and

2011 refunds were being held back and would be devoted to

this alleged liability unless the couple proved that they

didn't owe it.

Here are the notices:

(See the other four pages of this doc

here.)

(The common second page to these notices can be seen

here.)

OK, so let's summarize: Someone at the IRS reviewed George

and Sheila's 2010 and 2011 filings and agreed that they are

valid and correct. BUT, that someone is alleging that the

couple didn't file a valid self-assessment for 2008, and

contends that based on the agency's information the couple

owe a liability for that years totaling more than $8,400.00.

George and Sheila knew better, and said so:

You'll have noted that George and Sheila indicate that the

challenged 2008 filing is attached to this response. You can

see that attachment

here. Don't overlook the fact that this, too, is

testimony of $0 "income" received, with both Form 4852

rebuttals and 1099-MISC rebuttals, and a claim for the

return of all amounts withheld during 2008.

Faced with inarguable evidence that George and Sheila HAD,

in fact, filed dispositive testimony for 2008, and with no

valid way to overcome that testimony, but really wanting to

in the worst way, the someone at the IRS took what has

become the standard agency shot at evasion. He or she fired

off "LTR 3176" paper missiles-- for the new filings.

These threat letters were plainly an effort to get George

and Sheila to rescind their inconvenient testimony so the

United States could keep their money even despite the "no

return filed for 2008" nonsense having failed. Here is a

sample (first page only-- see the generic 2nd and 3rd page

of each of these

here if interested), followed by George and Sheila's

educated response (essentially duplicated in response to the

2011-related threat letter):

George and Sheila, good students of the law that they are,

had plainly paid attention to posts on this subject such as

those

here and

here. They responded appropriately:

Not quite ready to wave the white flag, the IRS agent took

one final shot-- another "LTR 3176" sent right after the

responses to the first one's arrived at the agency, but this

time for the 2008 filing (because if that got by George and

Sheila, the agent would regain the original pretext for

keeping their 2010 and 2011 refunds). This was met with the

same educated, point-by-point shredding of the "frivolous"

allegation premise.

That was it for the IRS agent. Recognizing that he (or she)

was dealing with stalwart, resolute and well-educated

Americans who take the rule of law seriously and mean to see

it prevail, the agent packed up his tent and moved on. The

next thing George and Sheila got from the government were two checks for everything

claimed for 2010 and 2011, plus interest:

WAY TO GO, GEORGE AND SHEILA!!!

But...

Watch out for that robot! I THINK

IT'S GOING TO EXPLODE!!

Isn't it too bad everyone hasn't done like

George and Sheila and read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help

transform America. Click

here to learn how.

|

|

An Unusually Instructive Victory In

Upholding The Law

EVERY NOW AND THEN A

CtC-EDUCATED VICTORY TEACHES an unexpected lesson. Brian

S.'s $14K+ refund is one such victory.

Brian had earnings in 2015 from

non-federally-privileged activities, from which $14,968.39 was

improperly withheld by ignorant payers as nominal federal income

tax, Social security tax and Medicare tax. Brian also had actual

federal "income" that year-- earnings from federally-privileged

activities, which had also been subjected to withholding, but

properly, in this case.

Brian's educated return reflected all relevant aspects

of both classes of economic activity. He reported $29,000+ in gains

from the taxable activities. Against this total Brian applied his

available exemptions and standard deduction and an available credit,

zeroing out the potential liability attendant upon the taxable

gains.

At the same time, Brian properly rebutted the erroneous

payer allegations that his non-federally-privileged earnings were

actually privileged and subject to the tax. Totaling all the federal

income tax withholdings made in connection with the non-privileged

earnings (nominal federal income tax, Social security tax and

Medicare tax), Brian faithfully reported the sum in the appropriate

place on his return. Continuing to follow the form's instructions,

Brian ended with a claim for a refund of that total amount withheld,

and on September 12, 2016 he received his claimed refund in full:

OKAY, SO FAR SO EXCELLENT, but really not unusual in

any respect. However, there's a bit more to this story.

Brian's 2015 return was his first educated return.

Brian hadn't found

CtC until Spring of 2016. As can happen on one's first steps

into the sunshine after a lifetime of being treated like a mushroom

by everyone a normal, honest man or woman would reflexively expect

to be honest as well, Brian had two minor stumbles while finding his

footing, and one of them makes Brian's victory a particularly useful

victory to explore.

You see, Brian inadvertently included with his return

the W-2 copies sent to him by his non-federally-connected payers.

This mistake was doubtless easy to make due to the fact that Brian

DID have to attach the W-2 he had been sent by his

federal-privilege-related payer.

Brian's mistake could have resulted in a rejection of

his return as a nullity. This is because the return contained

contradictory instruments-- W-2s alleging that he had received

privilege-related earnings from two payers in regard to whom Brian

also included forms 4852 rebutting those very same allegations. See

Brian's return

here.

But in this case the IRS employee processing Brian's

return actually did the part of his job calling for quality

"customer" service. About three weeks after Brian submitted his

return in early July that employee sent Brian a letter asking for an

explanation, focusing on the fact that even though the attached W-2s

showed $112,916.91 in earnings that would qualify as "wages" if all

were accurate as to the legal character of those earnings, Brian had

only reported $1,666.68 in "wages" on his return:

Brian immediately realized his mistake. He promptly

sent a response explaining what had been done and clarifying the

substance of his return, and offering to file an amended return if

necessary to straighten things out:

Five weeks later that $14,968.39 check was in

Brian's mailbox.

THE LESSON HERE is clear. Brian's refund claim of

everything withheld from his non-privilege-related earnings was

vetted in

the standard, extremely thorough fashion as have been all of

the hundreds of thousands of

CtC-educated refunds delivered to mailboxes across America

since 2003.

But Brian's claim called for and got extra

scrutiny, as well-- and then was honored in full, even though his

mistake could have been legitimately used as a pretext for

subjecting Brian to some grief, effort and delay before he received

the refund that was owed to him. Brian's experience teaches the

welcome lesson that even the IRS has decent people on its staff, who

do their jobs properly despite an easy opportunity to do otherwise.

So, hats off to Brian, for upholding the rule of law to

the benefit of all of us! But hats off, as well, to the anonymous

IRS worker(s) who did the right thing.

But let's not get complacent. I think I still need to

keep up the warning,

Watch out for that robot! I THINK IT'S

GOING TO EXPLODE!!

Isn't it too bad everyone hasn't done like

Brian and

read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help transform America. Click

here to learn how.

***

NOTE: I mentioned that Brian had made two mistakes on

this first-time educated filing. The one not really relevant to the

unusual aspects of this victory was overlooking the amount withheld

from his federal pension distribution, which should have been

included in the total amount withheld claimed for refund.

That amount did indeed get withheld from a taxable

payment, but Brian's exemptions, deductions and credits zero out his

liability, leaving him with no tax owed. Brian may find himself

doing that amended return after all...

|

|

Joe H.'s Victory-In-Progress

A wonderful exposé of an agency dodge

JOE H. IS A VETERAN educated filer.

Joe's

$14,690.00 complete federal refund for 2014 has been posted

since late spring of 2015; a year later he received a refund of what

was withheld during 2015.

Unlike the refund for 2014, though, what Joe has gotten

for 2015 so far is a "victory-in-progress". Here's what this means:

The United States has returned every penny of

what had been withheld from Joe during 2015 under the normal

"Subtitle A" tax provisions. In this case that was $7,927.00 which

was withheld under the provisions of Chapter 24 of Subtitle C of the

code. That type of withholding gets set aside in an escrow account

and then is credited against any tax which proves to be owing at the

end of the year, with the balance being refunded. (See pp. 174-175

of

CtC for the statutory provisions laying out this relationship.)

The form 4852 Joe filed as part of his return/claim (see

it here) shows the Chapter 24 withholding as the nominal

"federal tax withheld". Here is the IRS notice announcing Joe's

refund of this amount:

Here is Joe's bank statement showing the deposit:

The complete refund of this withheld amount is an

agreement that Joe owed no tax for the year-- had he owed anything,

this withheld amount would have been tapped to cover the liability.

Indeed, the IRS explicitly acknowledges that Joe had no "income" and

owed no tax, in harmony with this refund, on the second page of its

notice:

So, everybody agrees that Joe had no "income". In

particular (the significance of which will become clear in a

moment), everyone agrees that Joe had received no "wages"-- that's

the specially-labeled form of "income" under which Chapter 24

withholding takes place, and the species of "income" upon which a

Subtitle A tax will be presumed to have arisen in the case of a

worker like Joe. And again, everyone agrees Joe received no

"income".

But despite everyone agreeing that Joe had no

"income" upon which a tax liability could arise, the IRS is still

trying to get away with keeping a lot of Joe's money.

AS WILL HAVE BEEN NOTICED when looking at

Joe's sworn return/claim, and the 4852 included within it, Joe

had a good deal more withheld than just the $7,927.00 he has

received back so far. In fact, Joe's claim seeks $13,669.00-- the

total of all amounts withheld from him. This total includes not just

the nominal "federal income tax withheld" under provisions of

Subtitle C's Chapter 24 (the withholding for deposit against the

"normal tax" under Subtitle A) but also the Social security and

Medicare "income" taxes, which are withheld under the provisions of

Chapter 21 of Subtitle C (the withholding for the FICA "surtax" on

"income").

The IRS is trying a gambit on Joe, pretending that the

surtax wasn't withheld, or somehow should be excluded from the total

withheld, and hoping Joe won't realize what's going on. (Or the

agency hopes the boldness and incoherence of the corrupt ploy will

intimidate or confuse Joe into taking his partial refund and letting

the rest go).

The "explanation" given on

the

notice Joe received is almost comical:

The agency says "We didn't allow the amount claimed as

federal income tax withheld...because... supporting documents were

not attached..." And yet, not only was a supporting document

attached (Joe's Form 4852); and not only had the IRS (undoubtedly)

received a W-2 from the same payer whose erroneous allegations on

that W-2 are being corrected by Joe's 4852; but the agency DOES

acknowledge having received supporting documents, by agreeing that

at least the $7,927.00 was withheld.

How otherwise did the agency arrive at $7,927.00, which

happens to be exactly the amount discretely listed on Joe's

supporting document and the W-2 sent to the agency by the payer as

the amount of "federal tax withheld" (meaning, the amount withheld

under the Chapter 24 "normal tax" deposit provisions)? Plainly the

"explanation" given for excluding the Chapter 21 FICA withholdings

is nothing but a pretense, and a shabby one, at that. By itself this

phony explanation proves the agency has no valid ground for its

behavior here.

But here's where the gambit really stumbles:

By acknowledging that Joe received no "wages", the agency has agreed

not only that Joe received nothing subject to the "normal tax", but

also that he received nothing subject to the FICA "surtax"-- because

both fall on the same thing. The "normal tax" falls on all "wages"

received, and the "surtax" falls on the first $118,500 of the

same "wages".

So, the United States has already admitted that Joe

never actually owed any FICA surtax (just as Joe said on his form

4852 and by way of his return/claim for refund). It just wants to

keep the money anyway, in defiance of the plain statutory mandate at

26 U.S.C. § 3503:

26 U.S. Code § 3503 - Erroneous

payments

Any tax paid under chapter 21 or 22

by a taxpayer with respect to any period with

respect to which he is not liable to tax under such

chapter shall be credited against the tax, if any,

imposed by such other chapter upon the taxpayer, and

the balance, if any, shall be refunded.

Thus, Joe's victory is a victory-in-progress. Joe has

been handed flat-out admissions in favor of the remainder of his

claim, even while the United States plays it sneaky and hopes Joe

will let it keep a small bucket of his blood for the slaking of its

thirst.

THIS IS PRETTY OBNOXIOUS BEHAVIOR by the government.

And it's a shame that Joe will still have to pursue the rest of his

money.

But that said, there's an upside to all this, in a way.

This kind of game-playing by the feds illustrates and

emphasizes with unusual clarity

the liberating truth about the income tax. Deceptions and dodges

are only resorted-to when the truth stands against you, making the

government's very deliberate behavior here a particularly stark

admission that the knowledge informing Joe's filing and claim is

completely correct.

CONGRATULATIONS, JOE! Hats off to you,

for standing up for the law and the truth.

We all owe you.

But...

Watch out for that robot! I THINK IT'S GOING TO

EXPLODE!!

***

P. S. Joe's victory-in-progress joins those of the tens of

thousands of other awakened and activated Americans represented

here. It is another step toward the restoration of

the Founders republic and the true rule of law.

Don't you wish your victories were proudly posted, too?

It's easy. Stand up on behalf of

the law, and then

share the evidence.

That's all there is to it!

|

|

Jordan's Story

Those tasked with collecting the "ignorance tax" today

are reduced to utterly embarrassing ploys...

Here is how Jordan introduced himself to me a little

over two years ago:

Hello, I have a victory to report.

Throughout the 2015 tax year, I had

absolutely no money withheld from me. When tax time (Spring 2016)

came around, I was suckered into paying in thousands to the federal

government and about a thousand to the state of Minnesota.

Right after sending the checks and seeing

the money drained from my accounts, I found the Cracking the Code

book. I sent in amended returns and got everything back, plus

interest.

See the below images of the initial checks

sent in and the refund checks.

Just want to say thanks!

Accompanying that introductory email were images of

Jordan's payments to Uncle Same and the state of Minnesota that had

been sent in with his original "ignorance tax" returns:

Jordan also included images of the refunds he secured

two and three months later from both of these persons (with interest

from both) after almost immediately replacing both "ignorance tax"

filings with

CtC-educated amending returns--

this one

for Minnesota and

this one

for the feds:

Jordan even took the extra step, just after submitting

his amended returns, of seeking written confirmation from the Social

Security Administration of the changes he reported in his "wage"

receipts. The SSA promptly obliged with

the

expected report.

Well done, Jordan!!

***

Moving to 2017, Jordan again secures a complete refund

from Uncle Sam:

Only a little interest this time-- as you can see, most

of this complete refund of everything withheld from Jordan during

2016 was issued April 28, 2017-- within two weeks of "tax day", with

the rest following soon afterward upon Jordan correcting an error on

his original return by way of a 1040X.

Another fine victory for Jordan and for the rule of

law!

***

NOW LET'S LOOK at the fascinating story of what has happened (so far) between Jordan and Uncle Sammy

concerning Jordan's claim for the refund of what was withheld from

him during 2017. Things are a bit different this time.

The feds have

become increasingly unhinged in scatter-shot efforts to

keep their battered and clanking "ignorance tax" gravy-train limping

along despite

CtC having pulled up its tracks where anyone who studies the

material is concerned. Jordan has been made a test case for a new

and even more transparently-bogus variation on a ploy we've already

seen a few times-- one which is even more revealing of what's really

going on than past versions.

IN EARLY 2018 Jordan filed a now

well-practiced educated return just like his others, calling for the return of

everything withheld from him during the previous year. However, unlike in prior years

when it simply obeyed the law, this time a

sweaty-browed IRS decided it was going to try to hold on to at least

some of Jordan's

money.

The agency's struggle began with its issuance of

a

letter pretending that it had not received W-2s from Jordan's

payor-- the person who had done the withholding of amounts Jordan's

filing reclaims. We've seen this before many times now as a part of

the victory process for recent claims. See

here and

here, for instance.

Incorporated within this ploy is the additional

pretense that the tax agency has some legal authority under which it

can disregard Jordan's own sworn statements concerning those

withheld amounts, presented on his Forms 4852-- and can even do so while

lacking any competing or contradicting allegations (which its first

pretense asserts).

Remember, the agency has said (or definitively implied)

that it doesn't have W-2s, and thus is telling Jordan by way of its

notice that he must provide them to support his claims as to amount

withheld. As will be seen, this pretense is a falsehood-- the agency

contradicts it with another subsequent notice at which we will look

in a moment.

And just for the record, the agency has no authority by

which it can lawfully disregard Jordan's own testimony, regardless

of what allegations by others it might or might not have. You don't

have to take my word for that-- the ploy at which we are looking

right now proves that all by itself.

If the agency could disregard Jordan's return and its

claims, that's exactly what would happen and that's all that would

happen. But it cannot, and so this little effort to browbeat,

confuse and delay must be attempted.

JORDAN PROMPTLY fired off

a spanking-good response to the agency's first bit of nonsense.

The agency's reply was another-- and even more

bizarre-- pretense:

We've seen this one before, too. Here the tax agency,

bereft of any actual grounds on which it can pretend any claim to a

penny of Jordan's money as tax attempts instead to pretend that only

$312.50 was withheld from him, or can be reclaimed by him, instead

of the actual $4,409.96.

THERE ARE A MULTITUDE of interesting things to note in

this fraudulent agency proposal. To begin with, let's look at what

is said under the heading, "Changes to your 2017 tax return"-- an

amusingly pretentious heading from an agency that has no authority

to make any such changes.

Note that the agency's explanation for its dispute of

Jordan's withheld amount declaration is based on the supporting

document (W-2) which it earlier had pretended to not have. Note,

too, that the $312.50 that is proposed is, in fact precisely the

amount reported on that W-2 as the amount withheld under Chapter 24

of the IRC, as declared by Jordan on

his Form

4852. So the agency has here admitted that it's earlier claim of

lacking supporting documentation for Jordan's withheld amounts was a

lie.

NEXT, LOOK CLOSELY at the agency's declarations in the

"Your tax calculations" and "Your payments and credits" fields. In

both the "Your calculations" and "IRS calculations" columns, we find

plain, honest agreement that Jordan had only the $161.00 of

tax-relevant income that he reported on his return (in the form of

interest from a national bank).

Looking at the, "Your Payments and credits" field, on

the other hand, we see the equally plain lie about the total amount

withheld. Under "Income tax withheld, line 64", the IRS lists only

the $312.50 withheld from Jordan under the provisions of Chapter 24

of the IRC. Everything past that is declared to be $0.00s (including

the "Other credits, lines 66a, 67-73" field, a fact which will

become significant in a bit).

In its false assertion of the Chapter 24 withholding of

$312.50 as the total amount withheld, the IRS has simply omitted the

far larger amounts withheld under the provisions of Chapter 21 in

connection with the income surtaxes for Social security and

Medicare. The agency just wants to keep this money, and hopes

to do so by pretending that it was never withheld (or by hoping that

its omission will be mistaken by Jordan as being done in harmony

with some valid legal authority, and will be left undisturbed).

BE CLEAR ABOUT THIS: the agency is not actually

asserting some right to keep this money, which, of course, it hasn't

got. Indeed, the agency has admitted it has no such right, when

admitting that Jordan had no tax-relevant "income" and is entitled

to the return of all his Chapter 24 withholding.

Both Chapter 21 and Chapter 24 impose withholding on

the same events/receipts. (See

this brief if interested in the relevant legal structure.) Being

entitled to the return of the one means being entitled to the return

of the others (and the IRS knows this full well, as it has

definitively shown by having made

upwards of 250,000 such complete refunds over the last 15

years...).

Rather, the agency is simply pretending that the

Chapter 21 amounts were not withheld, or pretending that it can

lawfully withhold them from refund even though the events upon which

authority to withhold and retain those amounts is predicated never

happened.

In short, the IRS assertion of only $312.50 being

overpaid and liable for refund is an out-and-out falsehood, and

nothing more than that. It is grounded in no legal doctrine, and is

in simple defiance of the undisputed facts.

This IRS ploy is what I've come to label a

"victory-in-progress", in which some money has been returned, and

all the requisite admissions to establish the filer's undisputable

claim to the rest have been made. The agency bad apple responsible

is simply and obnoxiously leaving it to the aggrieved claimant to

take further steps to be made whole, while counting on the

likelihood of some to forego the effort, to Uncle Sam's benefit.

HAPPILY, JORDAN DOESN'T FALL into the "confused,

intimidated or mistaken" category. His

response to the "bad apple" at the IRS was immediate and

uncompromising, and even included yet another document supporting

his declared and reclaimed total amount withheld.

It seems that it was the IRS that found itself confused

and intimidated at this point. The next thing Jordan received from

the agency was

a request for his patience for a few months while the agency

figured out how to deal with this unwelcome pushback.

Finally, exactly 60 days after asking for 60 days (a

new record for the agency, which usually exceeds its predictions of

this sort by a wide margin), the IRS dropped the unique new load it

had taken two months to incubate as its desperate answer to Jordan's

indisputable claim and debunk of the agency's previous lies and

gibberish. Referencing the date it received Jordan's response to the

CP12 proposal as the "Date claims received" and the amount claimed

as Jordan's total withholding less the $312.50 it had proposed, the

agency offered this explanation for sticking to its pretenses (for

the moment) by way of

a LTR916C dated August 21, 2018:

"We can't process your claim for the tax periods listed

above. To claim excess social security tax, you must have reported

wages from more than one employer and the social security tax

withheld must exceed the maximum amount required for the tax year."

!!

Now, did anyone see anything whereby Jordan claimed

"excess social security tax"? Here is Jordan's 1040 "Payments"

field:

Look at line 71, "Excess social security tax (and tier

1 RRTA tax) withheld". See anything in that field? Remember the

IRS's own CP12 report that we looked at above, which itself

acknowledges $0.00 for "Other credits, lines 66a, 67-73"?

The agency resort here, after a couple of months to

struggle with its conundrum, is JUST MORE INCREASINGLY TRANSPARENT

BULLSHIT.

So, WELL DONE, Jordan, and don't stop now (I know you

won't...).

But,

Watch out for that robot! I think it's

going to explode!!

|

|

Sorry, Charlie, But No, We DON'T Owe

That Tax...

Another educated American couple send the tax-robot

reeling away

SCOTT AND DEBBIE GILLESPIE are a couple of real

Americans standing tall for the rule of law and for their rights.

Last week they won their second victory on behalf of both, turning

an IRS effort to tax earnings from work the Gillespies had said were

not taxable into a,

"Thank you for your response to the notice we sent to you about your

2013 taxes. We're pleased to tell you that the information you

provided resolved the tax issue in question and that our inquiry is

now closed."

Here's the story: In 2014, Scott and Debbie filed

this return concerning 2013. As is seen, Debbie did not dispute

the characterization of her earnings during that year as "wages"

(and a W-2, not included in this posting, was attached to the return

accordingly). But as is also seen, Scott DID rebut allegations from

HIS payer that his activities as a contractor (and the earnings that

resulted) were taxable.

The IRS didn't like that rebuttal, and very much

preferred Scott's payer's allegation. In October of 2015, the

agency sent Scott and Debbie a "proposed tax due" notice, reciting

the payer's numbers and calculating an unpaid tax liability for the Gillespies of $2,010:

But Scott and Debbie know the law, and were neither

intimidated, nor misled by this agency effort to get them to reverse

themselves and declare that what Scott does for a living is taxable

when they know it is not. Scott fired back

this letter in response to the "proposal", making all of this

perfectly clear.

A couple of long months went by, during which who knows

what was going on in the bowels of the bureaucracy. But finally, on

January 19, 2016, the IRS acknowledged the correctness of Scott and

Debbie's position:

HATS OFF TO SCOTT AND DEBBIE GILLESPIE, who stand tall

for the truth and the law!

Don't you wish everyone knew what Scott and Debbie know

about tax law, and stood up the way these good folks do? (Scott and

Debbie also have a lawsuit going to compel the return of amounts

withheld from them in Think of

what that would do to restore the American republic and the real

rule of law!

Seriously. Think about it.

But while you do,

Watch out for that robot! I THINK IT'S GOING TO

EXPLODE!!

|

|

William and Caroline Wadsworth March Tall and Straight-- Right

Over The Robot

William and Caroline Wadsworth filed a

CtC-educated return concerning 2011 acknowledging some

"income" and rebutting a half-dozen individual erroneous

allegations by payers that other of their receipts also

qualified as "income". Over a year later the IRS decided to try

to chivvy them back into the "ignorance barn" with the

livestock:

But these two American heroes refuse to be cowed by domestic

enemies of the law. They stood their ground and were rewarded

for their perseverance with this crisp and clear acknowledgment

of the truth about the tax as revealed in

CtC:

I'll let them tell their own tale, since they did so as clearly

as could be. Links to the documents involved will follow.

Here's the letter William and Caroline sent me with their

victory documents:

Here's the letter they shared with their legal assistant, which

summarizes the issue, what they did about it, and the outcome:

Now, see William and Caroline's 2011 filing

here.

See the IRS CP16 diversion notice

here.

See the IRS CP2000 effort to treat their perfectly common

unqualified earnings as "income" and subject to the tax

here.

See William and Caroline's educated response to this effort

here.

You've seen the IRS CP2005 acknowledging the truth, and

surrendering the fight, above; see the Wadsworth's transcripts

here.

WAY TO GO, WILLIAM AND CAROLINE!

But...

Watch out for that robot! I THINK IT'S GOING TO

EXPLODE!!

Isn't it too bad everyone hasn't done like William and

Caroline and read

CtC-- the exclusive source of the complete, accurate and

liberating truth about the "income" tax? You can help

change that, and thereby help transform America. Click

here to learn how.

|

|

Tony

Jackson has sent the robot away reeling

On April 15, 2011, Tony filed his return concerning 2010,

showing no "fed-come", and no tax due, while simultaneously

rebutting assertions to the contrary made by those who paid him

money that year:

On July 16, 2012, the ever-hopeful IRS took a shot at chivvying

Tony back into the barn and the role of pliant livestock,

resignedly serving as a fuel-source for their Leviathan client:

Inconveniently for the agency's preferences, Tony wasn't having

any, and responded like a grown-up American committed to the

rule of law and the Founders' intentions that their heirs should

be free and in charge:

A scant few weeks later, the IRS, recognizing that it was

dealing with someone who knows his rights and the law, and takes

both seriously, abandoned the corrupt ploy, and went off looking

for softer victims:

TONY FOLLOWED UP HIS STORY ABOVE with this

report in Spring, 2015:

Hello Pete,

I have decided to try to compile my story

with documentation for you to post. I think it's boring

but I wanted to share it. You do of course have posted

my initial

CtC filing for 2010 filed on 4/15/11, the

CP2000 7/16/12 and response letter 8/13/12, and last but

not least the CP2005 9/4/12 stating I owed nothing and

that the case is closed.

I sat on my laurels for the next

couple years thinking they might leave me alone even

though I had a number of years left to be filed. In Aug

2013 they sent a 688-W to my place of work seeking back

taxes for the year 2002 which was now 11 years old and

filed the wrong way. I had prepared for this some years

ago after reading CtC as I knew this would be the last

battlefront I would find myself on that they could truly

hurt me on, but I was hoping it would not come to this.

I was wrong.

I went through my files and your site and

found the section “A Sorry, But Instructive, Little

Subterfuge” and since I was not going to work for

nothing I had nothing to lose by challenging my place of

work on this. I constructed

a letter from the

information you provided there and added a thing or two

that I thought should be included since I was throwing

this at a totally green reader.

Most importantly I copied and pasted from

the IRC the entire section 'SECTION 6331. Levy and

Distraint. (a) Authority of Secretary'...As to leave it

in no uncertain terms that this was not my opinion but a

direct read of the code conveniently provided for my

work or his lawyers to investigate on their own.

I thought I was out of a job. Much to my

surprise the owner sent the affidavit I provided to the

IRS. I'm sure more to cover his rear, not mine, but as

it turned out, the matter simply vanished. Imagine that?

He has recently commended me on my fortitude in defying

them and expressed his pride in me.

As soon as I saw I was still in the IRS's

sights I decided to file all remaining years I was

sitting on which at the time was

2007,

2008,

2009,

2011,

2012. I did so all at once on 8/29/13. I did not want to

think they would start giving me trouble with 5 years so

I was a bit nervous.

On 10/7/13 I received a

CP24 which stated I

was due a refund of 200.00 for the year 2007, but I

would not be getting it because the statute of

limitations had been exceeded. I did not know what they

were talking about at first until I recalled making an

estimated payment for 2007 on the advice of the

accountant I had do 03-06 for me. I had not asked for

this, but it told me one thing....they had processed all

5 years I had just submitted as I had stated and since

2007 was the only year that had any discrepancy in math

that was all I heard about. I now had 6 years of taxes

successfully filed as CtC returns! This time there would

be no challenge of my knowledge, as I had shot down the

1099 in my 2010 return, I had shot down the challenge of

the CP2000, I had shot down the challenge of a 668-W (the

true feather in my cap here).

Even after I fought off an attempt at work

to steal my pay for taxes owed for 2002 they tried to

get me at home for 2002 with more junk mail. I decided

it was time to cut this off at the source. On 12/26/13 I

filed

an amended return (1040X) for 2002 and eliminated

any testimony they could use to harass me further. I

have heard nothing since. I shot that down too!

I've since filed

2013 and

2014 with no

incident. It is fast, easy and free. Except for the

certified mail I use to force feed it to them. I use a

witness and a certificate of service on each return to

seal the deal. That makes 9 solid years of CtC filings.

I have also helped a couple others

understand their rights and assisted them in their own

CtC filings. So far one has heard nothing and is

preparing to file 2 more years he is sitting on. The

other received the CP2000 in Feb and I assisted him in

responding to that. I wanted to show to you or whoever

might be interested, that they have changed the form to

be much less obvious than it was in 2013. I have

provided images to demonstrate.

You and your family have restored my faith

in America and have shown me that standing up for ones

rights is a simple as learning what they are.

Here

is Tony's 2017 video.

WAY TO GO, TONY!

But...

Watch out for that robot! I THINK IT'S GOING

TO EXPLODE!!

Isn't it too bad everyone hasn't done like Tony and read

CtC-- the exclusive source of the complete, accurate

and liberating truth about the "income" tax? You

can help change that, and thereby help transform

America. Click

here to learn how.

|

|

W. H.

has set the robot's head spinning

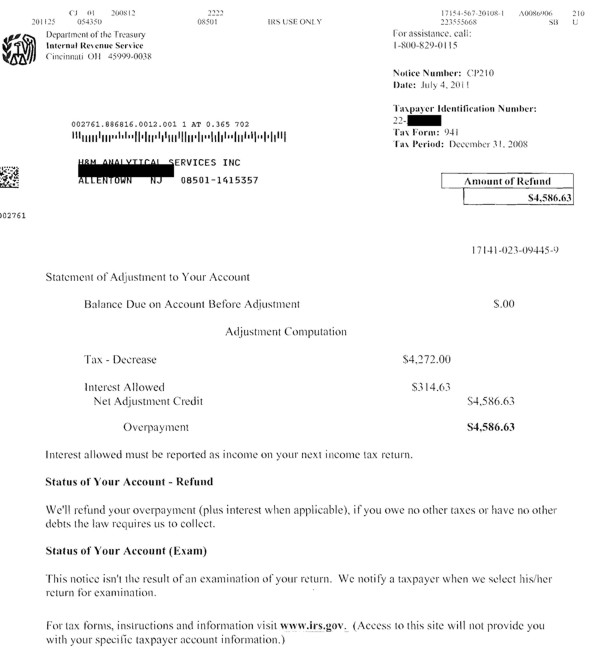

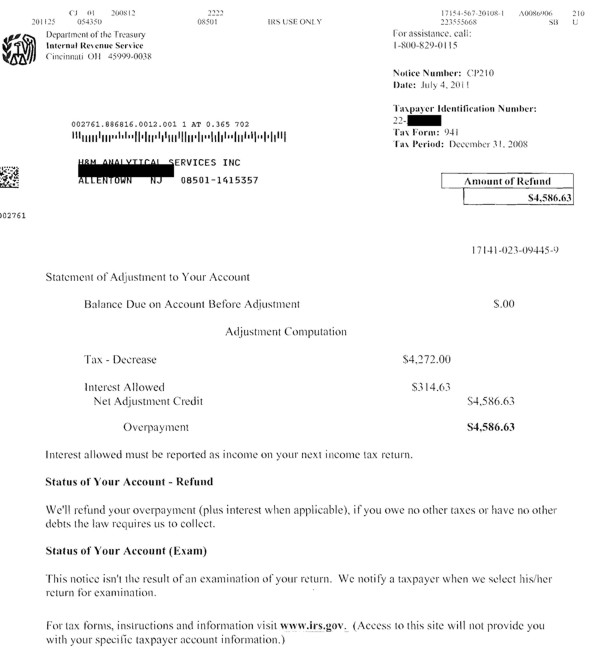

On August 20, 2010, W. filed

four educated claims for the return of everything deposited

with the federal government by his company during 2008 as

amounts withheld from workers previously mistaken to be

"employees" as the term is meant in "income tax" law,

accompanied by the following explanation (in relevant part):

Starting in July of 2011, W.'s company started receiving its

refunds, with appropriate interest:

You'll notice there's no check with this last notice-- one got

mailed, but was damaged in transit. W. promptly

sent off for a replacement.

Meanwhile...

Either while all these other checks were properly issuing, and

perhaps for that reason or perhaps having taken notice of W.'s

request for a replacement for the damaged check, someone in our

favorite bureaucracy decided to explain to W. that... well,

actually decided not to explain anything, because there isn't

anything legitimate to say except "Have a nice day." Instead

this someone decided to try to browbeat W. back into "ignorance

tax" servitude with a threatening "frivolous" notice of just the

kind discussed

here:

Being a well-educated student of

CtC and serious grown-up American who knows that left to do

so without people like him laying down the law and then standing

solidly on its behalf, people in these rogue bureaucracies will

always do the wrong thing, W. stood up tall, and laid it down

firmly:

Of course, the IRS stuck to THEIR sincerely-held, well-grounded,

legally-correct position, right? Well... no. A month and a half

later, what arrived in H & M's mailbox was not another threat,

but just this:

WAY TO GO, W.!

But...

Watch out for that robot! I THINK IT'S GOING

TO EXPLODE!!

Isn't it too bad everyone hasn't done like W. and read

CtC-- the exclusive source of the complete, accurate

and liberating truth about the "income" tax? You

can help change that, and thereby help transform

America. Click

here to learn how.

|

There ARE Honest, Law-Respecting

Federal Judges!!

CtC WARRIOR NATHAN ANDERSON introduces us to one of

these good souls-- Judge Dale S. Fischer of the United

States District Court for the Central District of

California. On October 10, 2012 and then again on November

6, Judge Fischer stood up and stood out from the pack.

Breaking a long and darkly-tarnished record of precedents by

her colleagues on the bench, Judge Fischer

firmly quashed a bogus IRS summons aimed at Nathan, and

then

denied a subsequent government Motion for

Reconsideration.

The summons had

demanded bank records in an apparent fishing expedition

intended to secure evidence of receipts which would have

been gratuitously used as a pretext for asserting that

Nathan had received "income". Nathan would then have been

put to the trouble of rebutting baseless allegations of

corresponding tax liabilities.

Judge Fischer's

rulings are significant because these summonses have

previously been routinely upheld by federal judges, who

all-too-often are mere enablers of IRS and DOJ bad behavior.

In a departure from that corrupt norm, Judge Fischer

recognized that her responsibility is to the law, rather

than to the state.

The rulings are ALSO

significant, and much more so, because in and by her

rulings, Judge Fischer recognizes that intrusive efforts

like the one attempted by the government against Nathan must

be in pursuit of a lawful purpose-- not to discover if a

valid basis for such intrusions exists. That is, intrusive,

privacy-violating efforts like this can only be permitted in

pursuit of an end for which a legitimate basis has

already been established.

The purpose alleged

here was the collection of tax liabilities. Absent proof

that such liabilities had been previously established and

assessed, the effort to submit someone's records to invasion

and scrutiny is illegitimate and unenforceable.

Here, the IRS was

attempting to harass a

CtC-educated American who had established that no

liability existed. Thus, there could be no lawful purpose to

the summons, and thus, despite being specifically challenged

to do so by the judge, the agency was unable to produce any

evidence of assessed liability. The best the DOJ and its IRS

client could do was the revealingly desperate argument that

since the agency isn't allowed to pursue collections

activities in the absence of an assessment, and WAS pursuing

such activities, the judge should just take it for granted

that there must be an assessment somewhere...

FINALLY, THE RULINGS

IN THIS CASE are ESPECIALLY significant because among the

alleged (but ultimately non-existent) "assessments" cited as

the basis for the summons was one for 2004:

Nathan, a good and

long-time

CtC warrior, had filed an educated return and claim for

complete refund of everything withheld in 2004, which

refund he duly received-- seven years before. (Nathan has

also received a complete refund for 2002 on an amended

return filed after this 2004 victory, and he and his wife

have received other subsequent state and federal victories.)

Anyone who has been harassed with bogus IRS threat notices

about "changed accounts" and other nonsense, or who has been

been wearied with ever-more absurd warnings from anyone to

the effect that, "All these

refunds are just slipping through the cracks. Eventually

they'll get noticed and "taken care of"!"

will find this plain evidence of the emptiness of such

nonsense of great interest.

Way to go, Nathan!

And our hats are off to Judge

Fischer, as well, who is clearly a public servant worthy of

her high office, and who understands what Dr. King meant

here:

"Cowardice asks the question - is it safe?