Can Anyone Say "Dazed and Confused"? Or Should We Just Say "Sly and Corrupt", As Usual?

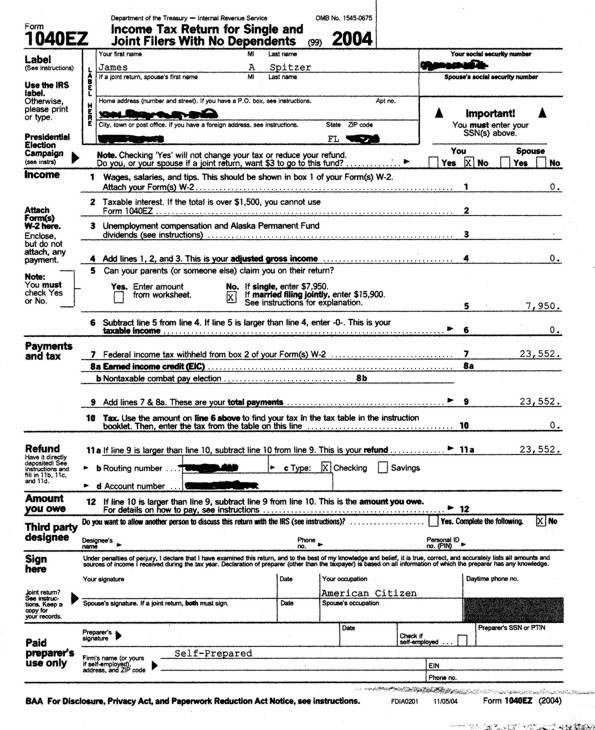

'Cracking the Code-...' warrior Jim Spitzer has just enjoyed a fascinating victory in his efforts to uphold the law. Jim received a refund for what was withheld from him by the federal government in 2004:

-- but not quite all of it. Although Jim had added together the amounts of nominal "federal income tax withheld", nominal "Social security tax withheld" and nominal "Medicare tax withheld", listed the total as nominal "federal income tax withheld" on his return, and claimed that entire amount, the government didn't include the amounts withheld under the Social Security and Medicare labels in the refund.

At the same time, however, Jim received a straightforward and explicit acknowledgement from the feds that he had $0.00 of the "wage" "income" by which both general taxes and Social Security and Medicare surtaxes (on the first $75,000 or so of "wages") are measured during 2004, just as he had declared on his 1040 and the associated 4852!

It is self-evident that if Jim received $0.00 in the "wages" by which Social Security and Medicare tax obligations are measured, his Social Security and Medicare tax obligations are: $0.00. It is equally obvious that if Jim's Social Security and Medicare tax obligations are $0.00, then he has a perfect right to reclaim any amounts that had been withheld against such obligations proving to exist, and the government, by the same coin, has no claim whatever under which it can keep those amounts...

Perhaps this is just an innocent mistake made by the functionary who processed Jim's return. Line 7 of the 1040EZ that Jim used indicates that the figure to be entered is what is found in box 2 of the filer's W-2(s) (which figure is also what ends up on line 'f' of a 4852). The number found in these respective places on both the W-2 submitted by the company that withheld from Jim, and on Jim's 4852, is the part of the total withheld that showed up on the refund check received so far.

So, maybe the IRS processor just innocently took for granted that Jim had inadvertently added ALL of the "income" tax withheld for inclusion on line 7, and was just being "helpful" in "correcting" Jim's "mistake". Indeed, the notice received with the refund more-or-less says this is the case. "...there is an error on your2004 Federal Income Tax return." "We changed the amount claimed as federal income tax withheld on line 7 of your Form 1040EZ to reflect the amounts reported on Form(s) W-2..."

Possibly this functionary wasn't aware that the instructions for line 7 of a 1040EZ are more explicit: "Enter the total amount of federal income tax withheld." (The instructions continue to say, in a separate line, "This should be shown on your 2004 Form(s) W-2 in box 2." [Emphasis added]). The 'service' does cultivate a reputation for incompetence which it trots out whenever bluster and snarling won't serve-- maybe that reputation is not just the convenient pretense that I imagine...

On the other hand, the cynical side of me can't help but wonder if Jim isn't just being invited both to "cut a deal with the devil", and quit claim to the rest of his money in exchange for being spared the hassle, and to entertain the sly suggestion that his understanding of the character of Social Security and Medicare taxes as just "income" taxes is wrong. Jim knows better, of course-- as to the latter, he's read the law; as to the former, there a matter of principle at stake (not to mention some $7,000.00 or so that he worked hard to earn).

Needless to say, the government's inviting Jim to get back down on one knee has no legal force; that's why the explanation accompanying his partial refund clearly acknowledges Jim's right to demand the rest of his money-- even if it does so in a fashion intended to misleadingly suggest that his means are limited to the government's in-house venues. This is kind of like your neighbor telling you that he's only paying you back half of the $100 you loaned him last week, and if you want to contest his decision, your sole option for doing so is to take the matter up with his wife.

There will be more to add to this story soon, I'm sure. Meanwhile, here are the documents relevant to this little comedy, which, while not really very amusing, is highly interesting... |

|

|

|

Jim has crafted a response to the errant IRS:

May 17, 2005 Internal Revenue Service Austin, TX 73301-0010 (via Certified Mail w/ Return Receipt requested) This is in response to your Notice CP12, a copy of which is attached and made part of this correspondence. You do not have the authority to disregard or alter my 2004 Form 1040EZ. If you disagree, please cite the specific IRC Section authorizing you to alter the Form 1040EZ filing of a non-privileged private sector American citizen. I expect to receive your answer within ten (10) days of the date on my USPS Return Receipt. If I do not receive it by that time, I will know that you realize there is no such authorization to be found. The change you made subtracted withholdings labeled Social Security tax withheld and Medicare tax withheld. I had no “income” to be taxed, and I owe no taxes measured by “income”. Therefore, all monies withheld for that purpose are to be returned to me along with any applicable interest, since the language of 26 USC 6402(a) relevantly states rather unambiguously that: (a) General rule In the case of any overpayment, the Secretary, within the applicable period of limitations, may credit the amount of such overpayment, including any interest allowed thereon, against any liability in respect of an internal revenue tax on the part of the person who made the overpayment and shall, subject to subsections (c), (d) and (e), refund any balance to such person. Promptly remit to me the remaining balance of $6,616 along with any and all applicable interest. If you are unable to do this yourself, please forward my file to someone with authority to do so. As a public servant, I expect and demand that you uphold the rule of law. I request and demand any and all due process to which I am entitled or which is in any way appropriate and/or available to me under any provision or practice of common, statutory, and/or administrative law or protocol including, but not limited to, that to which your notice refers; and incorporate by reference into this request and demand all relevant information included on or in that notice, a copy of which is attached. Be advised that it is my intention to audio-record any and all proceedings for which such an option is lawfully available to me. I declare that I make no admissions as to my status, the legitimacy of your implicit or explicit assertions, or the fitness of any particular legal or administrative protocol by responding to your notice or by requesting and demanding the due process referenced above. Prior to any formal or informal due process hearing, I expect and require meaningful clarification as to the nature of -- and reason for -- any alleged assessment, the process by which any and all relevant determinations reflected in and by your office were arrived at, and anything else pertinent to the matter. Sincerely, James A. Spitzer |