If You Want Something Done Right, You Just Have To Do It Yourself...

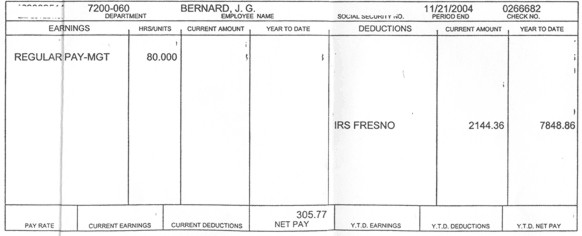

Michael and Janice Bernard had never filed a federal tax return for the year 2000, when in October of 2004, after a long period of increasing threats and demands, the IRS filed liens on their property and commenced garnisheeing more than $1,000.00 per week from Janice's salary. Not knowing what else to do, the Bernards sought out an attorney, who convinced them that filing a return was the only way to end their troubles. With the assistance of this "professional" (and for a considerable fee, no doubt), Michael and Janice prepared a return in the "conventional" (and IRS-preferred) way-- which is to say, without ever having read the law with which they imagined they were complying. This return declared them to owe $3,588.00 over and above what had been withheld from them during 2000 (an amount subsequently recalculated by the IRS to be $3,257.25). The return was submitted without any payment in regard to this additional liability, because the amount was, by that time, more than covered by what had been seized from Janice's earnings.

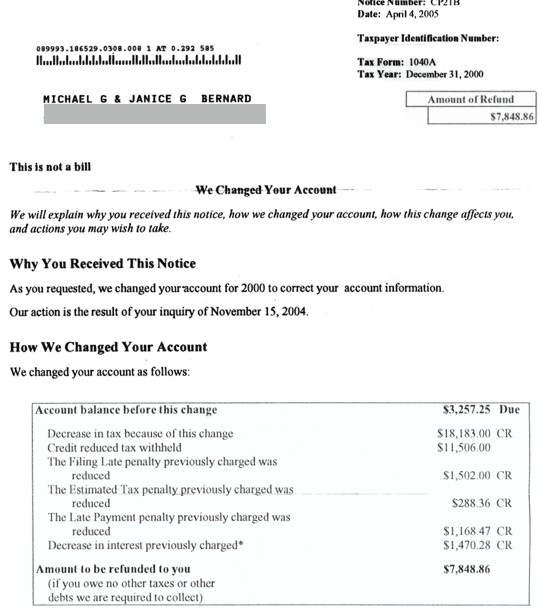

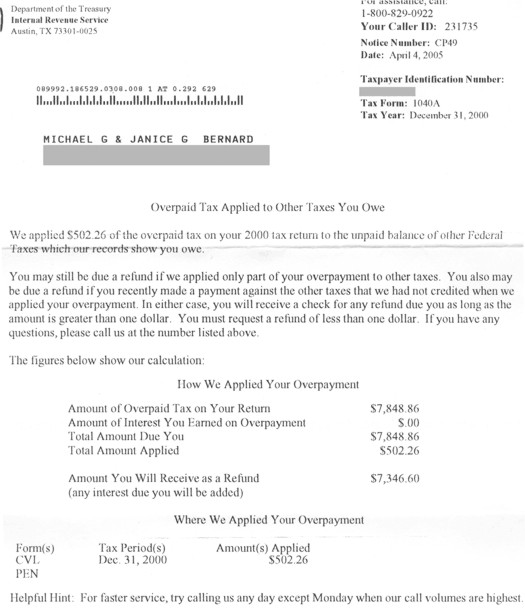

By an interesting coincidence, one week after putting this return in the mail, the Bernards learned about 'Cracking the Code- The Fascinating Truth About Taxation In America'. They immediately ordered a copy and read it through. Shortly afterward Michael and Janice, having now actually read the relevant law, filed an amended return for 2000. The new return not only showed no balance owing, but claimed a refund of everything previously withheld for that year. The result so far? The complete refund of everything seized from Janice's salary last autumn, and the lifting of the lien against the Bernard's property. Michael and Janice are now hoping for the return of the rest of the money given over to the government in connection with the year 2000 (which is to say, what was withheld during that year). |

|

|

|

(Although unspecified, as usual, it is reasonable to presume that the $500 'civil penalty' deducted is the 'failure to file' penalty.)