|

The liberating truth about the "income" tax is turning those

who would evade it

Every Which Way But Loose Part II

A collection of undeniable evidence of the

correctness of

CtC

Do you remember those old sci-fi movies (and numerous 'Lost in

Space' and 'Star Trek' episodes) in which an evil robot or a

computer collapses into terminal dysfunction after being

presented with data that "does not compute"? The machine

would flail about dangerously for a bit (or smoke and shake, and

threaten to explode) before finally going limp, silent and

harmless.

"LOOK OUT, DOCTOR SMITH!! DANGER!! WARNING!!"

Some

CtC Warriors are being drafted to play the part of the

intrepid heroes of these space operas lately, with federal and

state "income" tax agencies in the role of the neurotic robot.

SINCE AUGUST OF 2003, when the revelations of

CtC were first published,

tens of thousands

of readers of 'Cracking

the Code- The Fascinating Truth About Taxation In America' have taken

control of their own resources, in accordance with, and respect for, the

law. The total amount reclaimed by these good Americans so far is

upward of several billion dollars.

During the same period,

the IRS has engaged in a

desperate struggle to regain its hold of fear and confusion over

those now equipped with an understanding of the long-hidden

secrets of the "income" tax, and to stop that understanding from

spreading. This effort has involved the resort to many (and

increasingly) bizarre evasions and theatrics.

IN THIS SERIES, we take a close look at many of these gimmicks,

ploys and dodges. The action in these episodes will range from silly

one-shot, quickly-abandoned agency stalls to drawn-out, elaborate

efforts to resist or evade or discourage

CtC-educated filers ending in dramatic slap-downs of the

law-defying tax agency.

One consistent feature of all of these episodes is

the special clarity with which they illustrate the accuracy and

completeness of what

CtC reveals about the "income" tax. Unlike the vast majority

of

CtC-educated refunds and other victories in applying the

law in which the

deep vetting to which every claim is subject is done out of

view, with no evidence of the process except the filing and the

check or transcript, what happens in the cases highlighted in

this series takes place only after unambiguous, close tax-agency

attention to the claim.

Thus, these cases present a wake-up splash of

reality to those who struggle to persist in denial about the

truth, completeness and correctness of

CtC (some of whom actually argue with a straight face that

the hundreds of thousands of complete refunds issued over all

those years now from the feds and more than three dozen state

and local tax agencies are a sustained "slip through a crack"!).

Here it is in a word:

NOT ONE OF THE

SURRENDERS DOCUMENTED IN THIS SERIES WOULD OR COULD HAPPEN

UNLESS THE FILINGS AND CLAIMS MADE WERE CORRECT AND PROPER UNDER

THE LAW. NOT

ONE. Each of the victories

presented here took place with the knowledge and participation

of tax agency personnel. In almost every case, those victories

took place over and despite the outright resistance of those

officials.

Similarly, NOT ONE of the contortions and evasions

documented in this series would be attempted unless the filings

and claim against which they are deployed is correct and proper

under the law. It is the insurmountably correct character of

these educated filings that compels the tax agencies to resort

to smoke, mirrors and bluster.

Because these things DID and DO happen, the correctness of

CtC-educated filings and claims, and the view of the law on

which they are based, is indisputable.

Enjoy.

|

Dr. Jim Administers The Cure

DEDICATED TO LIBERTY AND THE RULE OF LAW, real

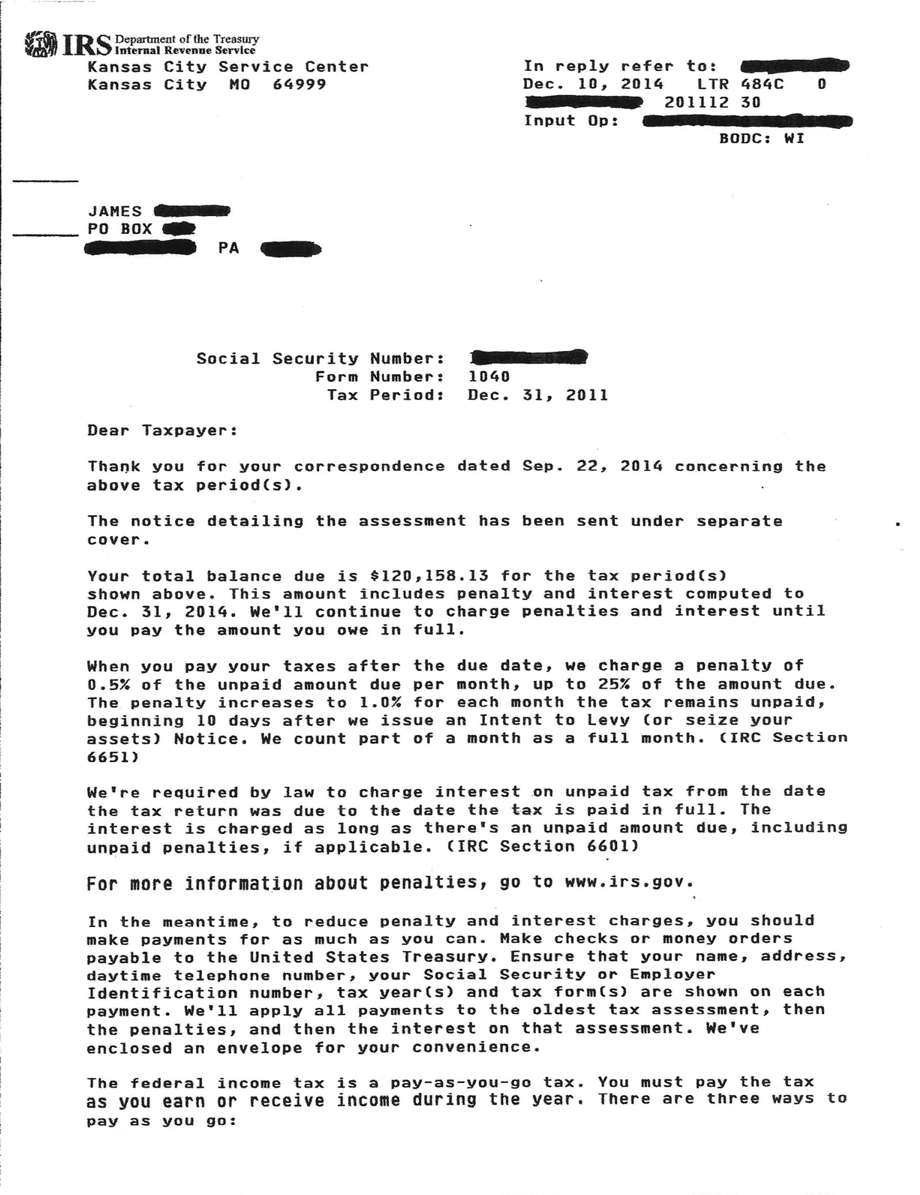

American grown-up Dr. James _ has done some educated

enforcement, just as the Founders meant for all Americans to do.

Having concluded that his earnings as a doctor in private

practice during 2011 didn't qualify as taxable, Jim said so in

the manner provided for by law, stood his ground, and shut down

a two-year IRS attempt to take more than $120K of his property

in connection with that year.

The end result of the argument was an IRS admission

that Jim's very considerable earnings do not qualify as "income" as

that term is meant in the tax law, and he had zero tax liability for

2011.

Here is Jim's filing presenting his testimony into the

record. It will be noted that Jim chose to do things a little

differently than most-- the information returns he was obliged

to address were 1099-MISCs, but rather than rebut them as most

folks do (a few hundred versions of which can be seen at links

on

this page), Jim chose to use modified Forms 4852, instead

(in keeping with the principles discussed

here).

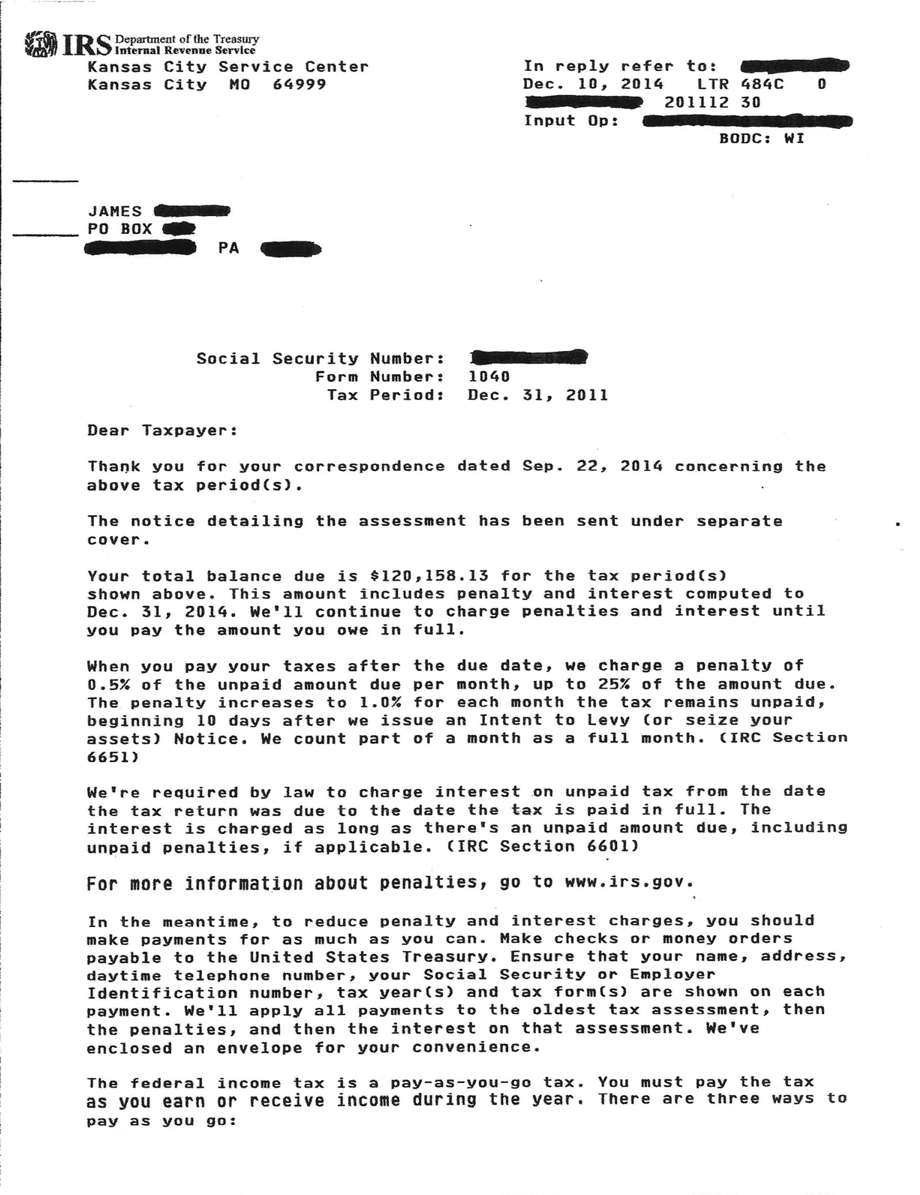

AS SOMETIMES HAPPENS, THE IRS decided to try to

chivvy Jim back into the copper-top barn. This effort began

with a 'notice of deficiency' in June of 2013 and then dragged

on for nearly two years, until the agency finally admitted

defeat in February of 2015.

Jim never went to "tax court", choosing instead to

just let his return testimony and a clarifying statement made

once the agency finally began to threaten to levy suffice. What

follows is the series of threatening agency notices

(interspersed with cryptic stalls where you can practically see

the robotic gears clashing as its presumptive fictions encounter

confidently-presented facts), Jim's calm and educated response,

and the denouement in which what had become an asserted "balance due"

of $120,158.13 by December, 2014 collapsed to an acknowledged $0

by February of 2015.

Enjoy.

And finally:

WELL DONE, JIM!!! Both in standing, and in

testifying. You are the sort of person that makes America

exceptional.

But...

Watch out for that robot! I THINK IT'S GOING TO

EXPLODE!!

Isn't it too bad everyone hasn't done like Jim and read

CtC--

the exclusive source of the complete, accurate and liberating truth

about the "income" tax? You can help change that, and thereby help

transform America. Click

here to learn how.

|

|

EVERY WHICH WAY BUT

LOOSE- XXIV

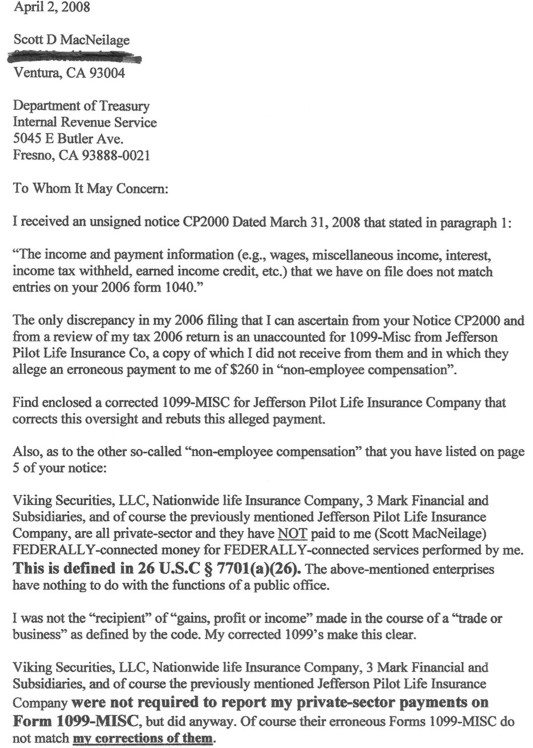

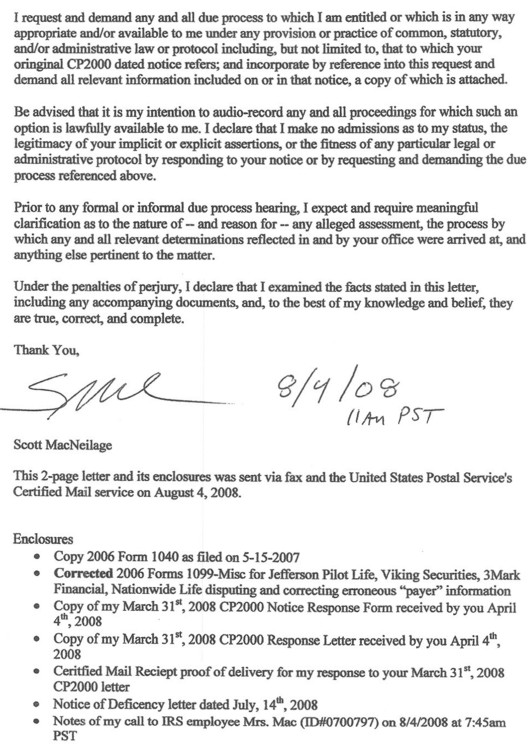

CtC Warrior Scott MacNeilage filed a conventional,

educated return for 2006 rebutting assertions that he

had received earnings from taxable-activities in May of

2007. Much to his surprise and annoyance, in April

of 2008, an IRS stooge, in the apparent hope that Scott

lacked complete understanding or confidence in his

knowledge of the law, decided to subject him to some

hassles. The stooge issued a "CP2000" proposing

that rather than the $0 calculated on his return, Scott

owed the federal government more than $26,000.00 in

outstanding tax liability for 2006:

As the note on the copy he sent me for posting makes

clear, Scott was neither confused nor intimidated.

He responded accordingly, with the following:

Non-plussed, the stooge quickly cranked out a "stall

letter" while considering its next step:

Eventually that call got made-- and almost within the 60

days promised! (This may be a new record for

"timeliness" in this regard...) Unfortunately, it

was not a good call:

Scott shook his head, and picked up the phone. He

ended up getting offered a ridiculous cock-and-bull

"troll ate my homework" story about his CP2000 response

having "been misplaced" (I wonder how many "ignorance

tax" filers ever hear nonsense like this?).

Nonetheless, Scott patiently responded again:

The IRS response? ANOTHER "We need time to decide

whether to face the fact that you've escaped the fog..."

notice:

Happily this time, at long last, the 'service' realized

that Scott has moved firmly into the army of

illuminated, never-going-back-to-slavery CtC-educated

Americans. Not even three weeks later the white

flag got hoisted and the 'service' reluctantly turned

its dark attention to other targets:

Watch out for that robot! I THINK IT'S

GOING TO EXPLODE!!

|

|

EVERY WHICH WAY BUT

LOOSE- XXIII

CtC Warrior D. Young's educated, proper and

oh-so-inconvenient to the IRS "bring in all possible

revenue by whatever means necessary" mission has

prompted a brand new variety of tax agency obfuscation,

as the truth turns the 'service' every which way but

loose. This new notice, "LTR 2893C", is of the

"We're pretending to not understand what your filing

means" "fog" class of dodges, and really is a piece

of work. Let's read it through:

(The entire notice is a bit longer

than the portion presented above, also explaining

interest additions that apply when an actual tax goes

unpaid, and giving options and instructions for

contacting the 'service'...)

Now, keeping always in mind that the object of this

"notice" is to give the 'service' cover for its failure

to honor D.'s filing and return her property while

preserving plausible deniability against possible

criminal charges for fraud and simultaneously sowing a

little confusion...

First of all, the "notice" invites the reader to imagine

that the amounts listed as Social Security and Medicare

withholdings (from the "wrong box(es)") aren't "federal

withholdings"! (Maybe those withheld amounts were

sent to France?)

The "notice" goes on to support this invitation to

fantasy by describing the numbers in those "wrong box(es)"

as not referring to amounts withheld at all, but rather

as being "record[s of] charges to your income to

provide for your future Medicare and Social Security

benefits..."

Really? Congress thinks differently.

When we look at the rules under which these "wrong box(es)"

on W-2s are to be filled out we find this specification:

"(6) the total amount deducted and withheld as tax

under section 3101 [of 26 USC]". Pretty

unambiguous.

Looking at section 3101 itself, we find:

§ 3101. Rate of tax

(a) Old-age, survivors, and disability

insurance

In addition to other taxes, there is hereby

imposed on the income of every individual a tax

equal to the following percentages of the wages

(as defined in section 3121 (a)) received by him

with respect to employment (as defined in

section 3121 (b))—

| In cases of wages received

during: |

The rate shall be: |

| 1984, 1985, 1986

or 1987 1988 or 1989

1990 or thereafter

|

5.7 percent 6.06

percent

6.2 percent

|

(b) Hospital insurance

In addition to the tax imposed by the

preceding subsection, there is hereby

imposed on the income of every individual a

tax equal to the following percentages of

the wages (as defined in section 3121 (a))

received by him with respect to employment

(as defined in section 3121 (b))—

(1) with respect to wages received

during the calendar years 1974 through

1977, the rate shall be 0.90 percent;

(2) with respect to wages received

during the calendar year 1978, the rate

shall be 1.00 percent;

(3) with respect to wages received

during the calendar years 1979 and 1980,

the rate shall be 1.05 percent;

(4) with respect to wages received

during the calendar years 1981 through

1984, the rate shall be 1.30 percent;

(5) with respect to wages received

during the calendar year 1985, the rate

shall be 1.35 percent; and

(6) with respect to wages received

after December 31, 1985, the rate shall

be 1.45 percent.)

Plainly, the amounts listed in those "wrong box(es)" are

amounts of federal withholding (and are withheld as

payments of the "income" surtax imposed and arising when

[and if] "wages (as defined in section 3121 (a))

[have been] received by [an individual] with respect to

employment (as defined in section 3121 (b))" ).

(Further, and without regard to the issue of whether D.

actually had any "income" against which they could have

been "charged", they AREN'T "charges... ...to provide

for [D.'s] future Medicare and Social Security

benefits", as is flatly declared by the United States

Supreme Court in Helvering v. Davis 301 US 619 (1937):

"The

proceeds of both [employee and employer FICA] taxes

are to be paid into the Treasury like

internal-revenue taxes generally, and are not

earmarked in any way."

...and in Flemming v. Nestor 363 US 603 (1960):

"The

noncontractual interest of an employee covered by

the Act cannot be soundly analogized to that of the

holder of an annuity, whose right to benefits are

based on his contractual premium payments."

The court explains, also in Flemming v. Nestor, that:

"To

engraft upon Social Security system a concept of

'accrued property rights' would deprive it of the

flexibility and boldness in adjustment to

ever-changing conditions which it demands..."

It's that simple. There is no legal relationship

of any kind between what is withheld under the auspices

of the "Federal Insurance Contributions Act" (FICA) and

the receipt, or possible future receipt, of Social

Security or Medicare benefits-- and this is true even

for those whose earnings really are "wages" as that term

is defined in the law.)

BUT THAT WAS ALL just the warm-up. The real thrust

of this obfuscation-by-notice is the rest of the line

debunked above: "...[these charges] may not be used

as deductions to your Income Tax. Only the amount

in Box 2 of a W-2 may be used to reduce or eliminate

tax." (As an aside, I am struck by the

capitalization of "Income Tax". Is the tax now an

object of worship for these folks?)

Where do we start?! First of all, amounts withheld

under the protocols involved here don't get used as

"deductions"-- they are credits against a tax liability,

if any tax is owed. The (doubtless)

bullet-sweating IRS staffer tasked with drafting this

verging-on-mail-fraud "notice" knows this, of course.

My guess is that he is trying to work some plausible

deniability into the picture by suggesting that a

provision in the FICA to the effect that any amounts

properly withheld can't be deducted from one's total

amount of "income" declared as having been received--

even though one hasn't actually received those amounts--

was on his "confused" mind, and is the cause of the ...

(That provision, which, in the original enactment of the

Social Security Act of 1935 reads:

SEC. 803. For the purposes of the income tax

imposed by Title I of the Revenue Act of 1934 or by

any Act of Congress in substitution therefor, the

tax imposed by section 801 shall not be allowed as a

deduction to the taxpayer in computing his net

income for the year in which such tax is deducted

from his wages.

is entertainingly reflected in the following language

from the FICA chapter in the current IRC (chapter 21),

which I suppose might put anyone into a state of honest

confusion:

§ 3123. Deductions as constructive payments

Whenever under this chapter or any act of Congress,

or under the law of any State, an employer is

required or permitted to deduct any amount from the

remuneration of an employee and to pay the amount

deducted to the United States, a State, or any

political subdivision thereof, then for purposes of

this chapter the amount so deducted shall be

considered to have been paid to the employee at the

time of such deduction.

Anyone who has persisted in harboring doubts about the

fact that these tax protocols only apply to

federally-connected persons who have voluntarily,

deliberately and knowingly accepted them by, for

instance, joining the civil service should be disabused

of that mistake after reading provisions of this

kind...)

This leads into the second complex pretense deployed in

this "notice", because what ARE properly used as

deductions involve provisions of law by which portions

of what DOES constitute "income" are subtracted from the

gross amount of "income" declared, resulting in a net

amount which ends up being the measure of any resulting

tax (against which tax credits can then be taken, when

available). That is, deductions have no purpose or

effect unless there is "income" in play.

This exercise of craft is emphasized by the careful

wording of the next line: "Only the amount in Box 2

of a W-2 may be used to reduce or eliminate tax."

The fact is, the "amount in Box 2 of a W-2"-- the

nominal "federal income tax withheld" amount-- CAN'T be

used "to reduce or eliminate tax"; it is a PAYMENT of

the tax, when and if it is subsequently determined that

a tax is actually owing for the period in question.

Only reducing the amount of "income" being taxed can

"reduce or eliminate tax" (such as by taking an

available deduction-- see how this clever nonsense goes

full circle?). But wording the line the way it has

been done blends it with the morass of prior

disinformation into a comprehensive fog, if you'll

pardon the incongruity of the expression.

Now we come to the heart of the whole exercise, because

everything discussed about this "notice" so far has been

part of an elaborate effort to dodge the simple fact

that, like the "amount in Box 2 of a W-2", the amounts

in boxes 4 and 6 of a W-2 (the famous "wrong box(es)")

are only lawfully retainable by the government AS

PAYMENTS OF TAX, and can ONLY be retained when "wages

(as defined in section 3121 (a)) [have actually been]

received by [an individual] with respect to employment

(as defined in section 3121 (b))". If such

"wages" HAVE NOT been received, the government simply

has no claim to the withheld amounts, no matter what

kind of nonsense it cares to suggest about their

character or the reason for their appearance in a

filing.

There's the bottom line on this bogus "notice".

The 'service' is seeking to evade the substance of D.'s

filing, and, secondarily, to discourage D. from

proceeding with her claim for the return of her property

by trying to baffle her with b*llsh*t-- because that's

all its got to work with.

Watch out for that robot! I THINK IT'S

GOING TO EXPLODE!!

|

|

EVERY WHICH WAY BUT

LOOSE- XXII

"FRIVOLOUS!" "WE PROPOSE...!" "WE CHANGED

YOUR ACCOUNT!" CtC Warrior Justin_ heard all of

that from the IRS in its effort to thwart

his filing for 2006. First there was this:

...to which Justin responded with this:

...and

this.

The 'service' then trotted out this:

...to which Justin responded with

this.

Then this arrived in the mail:

...but before Justin even got around to responding to

this nonsense (which seeks to recapture

Justin's "telephone tax" refund-- the only thing he

had claimed and received for the year), the 'service'

grimaced and abandoned the exercise with the following

admission that the more-than-$130,000.00 he earned

during 2006 in his perfectly normal,

non-federally-connected activities simply doesn't

qualify as "income" and that, although he had paid in

nothing, had had nothing withheld, and had no credits to

apply, he owed no "income" tax for the year (even the

variety called "Social Security and Medicare

contributions"):

Watch out for that robot! I THINK IT'S

GOING TO EXPLODE!!

Isn't it too bad everyone hasn't done like

Justin, and read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help transform America. Click

here to learn how.

|

|

EVERY WHICH WAY BUT

LOOSE- XXI

"WE PROPOSE...!" "WE CHANGED YOUR ACCOUNT!"

"YOU OWE US A LOT OF MONEY!!!" CtC Warrior

K. T. heard all of that from the IRS in its effort to

thwart

his filing for 2006. K. had filed an educated

return, including rebuttals to a variety of ignorant

payer allegations that money paid to him was a result of

his engaging in taxable activities, in April of 2007.

A year later, the IRS decided it'd have a go at scaring

K. into reversing (and perjuring) himself. This

effort took the form of a "disputation" with K.'s

reported "income" totals, and a proposed balance due of

more than $44,000.00, based on the agency's self-serving

preference for the allegations of K.'s payers:

K. was not impressed, and not intimidated, having a

complete,

CtC-solid knowledge of the law. He responded

accordingly:

...and the 'service', being squarely faced with

confirmation that it was dealing with a serious,

dedicated, no-going-back-to-the-farm warrior for the

truth, did likewise:

This is K.'s SECOND such victory on behalf of the truth

and the rule of law. His first, putting to rest an

assertion of a $43,000.00+ balance for 2005 last year,

can be enjoyed at

www.losthorizons.com/tax/MoreVictories23.htm.

Watch out for that robot! I THINK IT'S

GOING TO EXPLODE!!

Isn't it too bad everyone hasn't done like K.,

and read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help transform America. Click

here to learn how.

|

|

EVERY WHICH WAY BUT

LOOSE- XX

Warrior Bill Granger, who has won several victories so

far but also has a couple of corrections-of-the-record

filings being strenuously resisted by the IRS, has been

getting a particularly sustained run-around by an agency

desperate to dodge reality in regard to Bill's filing

for 2004. Just a few weeks ago, the dodging got

truly surreal.

On November 7, that agency sent Bill the following

"ignore that man behind the curtain" scary-paper (of the

sort dissected in detail in episode VII of this series):

Note the reference to "the information you filed as a

return of tax, or purported return of tax, on Apr. 18,

2008", which, it is alleged, has been "determined"

to be "frivolous" and has thus prompted this "notice".

Now, Bill hadn't filed anything related to 2004 last

April, but he HAD sent something concerning that year to

the 'service' that would have arrived in an IRS office

around the 18th of that month. What Bill had sent

was a response to this:

(This is a compilation of material from the front and

back of the original.)

Here is that response, which was mindlessly

characterized by the Robot as "the information you

filed as a return of tax, or purported return of tax, on

Apr. 18, 2008", about which a "determination" is

alleged to have been made by someone. Read it with

sympathy for Bill for his having to put up with this

extended tax agency evasion, but also with amusement,

and appreciation of how plainly the entirely fictional

nature of these IRS scary-paper assaults is exposed by

this particular example.

|

William R. Granger

April 14, 2008

Certified Mail :____________________________

Internal Revenue Service

ACS Support – STOP 5050

PO Box 219236

Kansas City, MO 64121-9236

Re: Letter 4903 dated Apr. 07, 2008

To: Ms. Debra K. Hurst

I am in receipt of your letter wherein you

state “We previously asked you for

information about your tax return(s) shown

on the back of this letter.” The

reverse side references a 2004 Form 1040.

You further go on to say “We have no record

of receiving your reply….”

Please be advised that I deny your

assertions in their entirety. Your

office has NEVER requested my 2004 return,

other than an Appeals Officer who wrongfully

denied me due process by alleging she didn’t

have this return; which was sent to her

twice. Furthermore, the IRS has been

provided this return on multiple occasions.

Please permit me to provide you a chronology

regarding my 2004 return:

April 14, 2005 1040 completed and subscribed

by me

April 15, 2005 1040 Placed in the US Mail

under certified mail number 7000 0600 0027

5139 4202

April 23, 2005 Received in your Fresno, CA

office, as denoted by signature card bearing

your stamp. Received by L. Vasquez at

1:16pm. This was my first submission.

August 2005 I requested, by

phone, a copy of account transcripts for

several tax years

September 2, 2005 Received transcripts

from Ms. Linda Thornton, making no mention

of any missing returns

October 31, 2005 Received another reply

letter from Mr. Corliss M. Hicks, of your

RAIVS Unit in Doraville, GA, stating he had

no record of my returns from 2001-2004, even

though Ms. Thornton provided transcripts for

those very years.

November 16, 2005 I emphasized that I

had filed these returns, and informed Mr.

Hicks I held receipts for deliveries of

these returns; I renewed my request for

detailed information regarding these

accounts, and he never replied, and he

certainly made no request for copies. Even

so, I mailed him copies of all 1040s for

these years, hoping to find someone

competent in the IRS. This

was the second submission to the IRS.

November 30, 2005 I met with a MR.

Waters at the IRS Appeals Office in

Richmond, VA to discuss several tax years in

question. At that time, I presented

him with tax returns for multiple years,

which included 2004. This was the

third submission to the IRS.

March 10, 2007 I received a

“REMINDER NOTICE,” Letter 3228, from YOUR

KANSAS CITY PO BOX, YOUR STOP 5050, kindly

‘reminding’ me of allegations of debt; the

significant part being your note on

the back simply saying “TYPE OF RETURN” and

identifying my 2004 1040, but making no

comment as to its status. I promptly

wrote you and explained your inference that

my 2004 1040 was in question confused me,

and requested further information as to the

problem. My letter was sent certified,

number 7006 2760 0003 9158 8080, and was

received in your offices at 10:30 am, on

4/24/2007. I told you then, as I

tell you now, my 2004 1040 has been in your

custody since 4/23/2005. YOUR OFFICE

NEVER REPLIED, NOR DID IT EVER MAKE ANY

REQUEST FOR MY 2004 RETURN.

During recent events involving my attempts

to get a competent hearing from the IRS

Appeals Office in Memphis, I was compelled

to send yet another copy of my 2004 1040 to

the IRS. I did so under certified

mail, number 7007 0220 0002 6782 0476, which

was received on 10/19/07. That package

contained a copy of the 1040, and the Return

Receipt verifying a timely filing.

That was the fourth submission to the IRS.

Once again the IRS misplaced this return

such that AO Mrs Banks felt justified in

moving forward without my submissions. I

therefore sent it again, via FAX, on

11/1/07, making this my fifth submission to

the IRS.

Now along comes

your office, claiming ignorance of any

communications from me, and “no record of my

filings.” So I am here again

providing a COPY of my 2004 return, with yet

another original signature.

Since this is a copy of my original

submissions, I will sign close to, but not

over the copy of the original signature.

This is my sixth submission to the IRS,

having never received any reply at any time,

nor any request for more information.

This record of submissions, followed by

absolutely no feedback to me from your

offices, demonstrates an IRS pattern of

obfuscation apparently intended to thwart my

subscribed testimony, with the apparent goal

of substituting a return more to its liking.

There is absolutely no authority for you to

disregard my return, especially without

notifying me in accordance with IRC 6210.

If you believe you have such authority

please inform me. All Americans

would be surprised to know the IRS can

replace a return with whatever facts it

deems correct.

For the record, I am sending you this two

page cover letter, five pages of 1040

w/supporting documents, and a copy of the

delivery receipt.

William R. Granger

|

Nothing more needs to be said, I think, except,

Watch out for that robot! I THINK IT'S

GOING TO EXPLODE!!

Isn't it too bad everyone hasn't done like Bill,

and read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help transform America. Click

here to learn how.

|

|

EVERY WHICH WAY BUT

LOOSE- XIX

Warrior Bruce G. got run through the whole gamut of IRS

dodges and balkiness revealed (and debunked) in this

series, the Lost Horizons Newsletter 'Tax Tip' feature,

the FAQ pages and elsewhere on this site before finally

prevailing with his filing for 2004. This all

began with an IRS "Proposed Assessment" for 2004, a year

for which Bruce, being at the time not yet CtC-educated,

had never filed:

Having gotten that belated education, Bruce responded on

February 5, 2008 with

an original return, which rebutted "information

returns" created about him by others, and declared that

none of his earnings met the legal definition of

"income".

Bruce had the misfortune of being selected for a

sustained "frighten/confuse him back into the pen"

campaign, however...

First came a Notice of Deficiency:

Bruce responded with the following:

Meanwhile, a "LTR 3176" for the same year had also shown

up in Bruce's mailbox:

Bruce responded with a personalized version of

this.

The IRS wasn't going to give up that easily, though...

In August, this upgraded version arrived:

Bruce again responded in a straightforward, educated (if

understandably exasperated) manner:

Crossing his response in the mail came the next salvo of

increasingly desperate B.S.:

Are we having fun yet?!

Bruce once again rapped out a cogent, pointed reply:

|

Certified Mail #

Scottsdale, AZ 85260

September 4, 2008

Internal Revenue Service

P.O. Box 9019

Holtsville, NY

11742-9019

RE: Notice CP22A dated

August 25, 2008

Dear Unnamed IRS Employee:

I do not agree with the

contents of your notice!

I filed and signed under

penalty of perjury my 2004 Form 1040 and

also signed a similar statement on the

attached 1099-B spreadsheet!

Your notice is merely an

assertion. You have no authority to

make any unilateral changes to my return,

even under the assumption that it is somehow

“frivolous” to thus be able to employ the

protocol prescribed at 26 USC 6020(b).

The Internal Revenue Manual specifically

excludes the Form 1040 from the list of

prescribed tax forms that may be executed by

the Secretary under that section! What

you have done and are presently doing is

illegal!

Section 6201(d) of the

Internal Revenue Code is reprinted below for

your convenience:

Sec. 6201- Assessment authority

(d) Required reasonable verification of

information returns

In any court proceeding, if a taxpayer

asserts a reasonable dispute with respect to

any item of income reported on an

information return filed with the Secretary

under subpart B or C of part III of

subchapter A of chapter 61 by a third party

and

the taxpayer has fully cooperated with the

Secretary (including providing, within a

reasonable period of time, access to and

inspection of all witnesses, information,

and documents within the control of the

taxpayer as reasonably requested by the

Secretary), the Secretary shall have the

burden of producing reasonable and

probative information concerning such

deficiency in addition to such information

return.

Additionally, please provide

me a copy of the record of assessment for

2004 pertaining to the amount on the

attached copy of your Notice CP22A as is

allowed by the provisions of 26 USC 6203:

“…Upon request of the

taxpayer, the Secretary shall furnish the

taxpayer

a copy of the record of the

assessment;…” (bolding and underlining

added)

within 30 days from the date

of your receipt of this letter as confirmed

by postal return receipt or through

www.usps.com.

An aggregate record will not

satisfy this request. Adequate

compliance with this request requires

documentation sufficient to clearly

establish my personal liability. I

demand an actual photocopy, with the

signature of the assessment officer

included. The reason for this request

is both to establish the existence of the

assessment, and to determine for myself the

assessment's complete compliance with all

related provisions of law.

The making of this request is

not to be considered or construed as an

admission of "taxpayer" status or of

liability for any tax or penalty.

Refusal to cooperate with this request will

be recognized as an acknowledgement that I

am NOT, in fact, liable for the tax or

penalty alleged to be due and owing or

otherwise collectible in any manner on the

above-mentioned Notice CP22A.

Unless the IRS has factual

knowledge of my private finances superior to

my own and can prove such per 26 USC 6201

and 6203, please provide that information so

I can respond. If you don’t have personal

knowledge of the facts, I will assume this

matter closed.

Sincerely,

Bruce G.

|

The bad actors at the agency still weren't quite ready

to give up...

This came next:

Bruce, probably really straining by now to keep his

temper, delivered this in response:

Finally, responsible parties at the 'service' had had

enough. Throwing up their hands, they shrugged and

did what should have been done eight months prior:

Bruce, having seen the agency's manic and corrupt

obstinacy in action for so long in this case, didn't let

it rest at that. He promptly FOIA'd for a

transcript of his IRS "account" for 2004, just to verify

that reality has indeed been properly acknowledged.

It has:

(Note that the $5000 Frivolous Penalty "charged" to

Bruce back in August makes no appearance on the

transcript, having obviously been a completely

fictitious assertion...)

Way to hang tough and tight, Bruce!

But,

Watch out for that robot! I THINK IT'S

GOING TO EXPLODE!!

Isn't it too bad everyone hasn't done like

Bruce, and read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help transform America. Click

here to learn how.

|

|

EVERY WHICH WAY BUT

LOOSE- XVIII

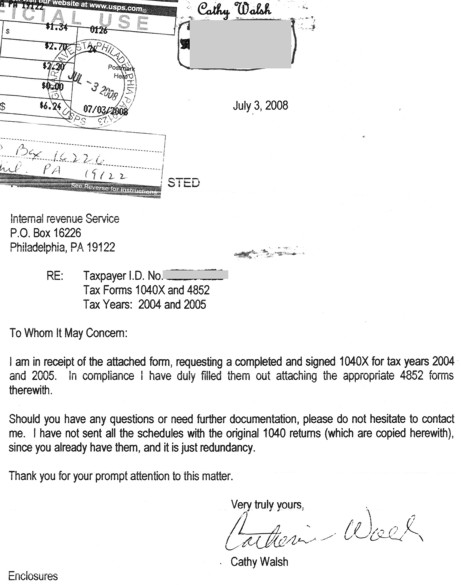

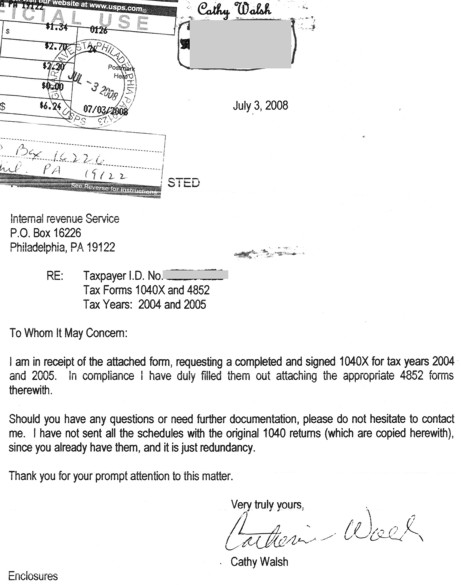

CtC Warrior Cathy Walsh learned the truth about the tax

just a year ago or so, and wasted no time in putting her

new knowledge to work. On April 16, 2008, Cathy

notified the IRS that she had woken up and moved out of

the barn:

The 'service' ruminated for awhile, and then

replied that Cathy's views were all very well,

but nothing could be done without an appropriate

return:

(Reference is made here to both 2004 and 2005,

each of which Cathy has acted to address-- her

claim for the latter year appears to STILL be

turning the agency every which way but loose,

and will doubtless find it's way onto this page

at a future date...)

Cathy responded as requested:

Click

here to see Cathy's amended return.

Three-and-a-half months of delay ensued before

the 'service' finally responded with a what

proves to be a desultory, perhaps even

reflexive, "disallowance" notice:

Shortly afterward, it appears that some

responsible party actually checked a calendar

and did a little arithmetic:

Way to go, Cathy! The air is nice outside

that barn, isn't it?

***

Watch out for that robot! I THINK IT'S

GOING TO EXPLODE!!

Isn't it too bad everyone hasn't done like

Cathy, and read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help transform America. Click

here to learn how.

|

|

EVERY WHICH WAY BUT

LOOSE- XVII

CtC Warriors Chris and Janis Ortwein had the briefest

encounter with the robot on record so far, I think...

In April of 2007, Chris and Janis filed a

routine, educated return rebutting erroneous payer

assertions. It was much to their surprise that

nearly a year later, the IRS deposited a smelly little

present in the Ortwein mailbox:

Chris and Janis were surprised and annoyed at

this baseless flailing about by the agency, but

ended up not even having to bother with a reply.

Someone at the IRS apparently recognized the

agency's faux pas, and two days before the

indicated response date, a friendly (or at

least, polite) "closing notice" arrived:

Total turn-around time: 28 days...

Watch out for that robot! I THINK IT'S

GOING TO EXPLODE!!

Isn't it too bad everyone hasn't done like Chris

and Janis, and read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help transform America. Click

here to learn how.

|

|

EVERY WHICH WAY BUT

LOOSE- XVI

CtC Warrior "Anonymous in Illinois" had to deal with a

few speed-bumps thrown in his path by the state of

Illinois before getting back all of the property that

had been withheld from him and put into the state's

keeping during 2007 against the possibility that his

economic activities throughout that year might've been

"income"-taxable. Anon. stuck to his guns, though,

and while Illinois' efforts to evade the law delayed the

satisfaction of his claim for almost a year, when that

satisfaction came, it came with appropriate interest

added...

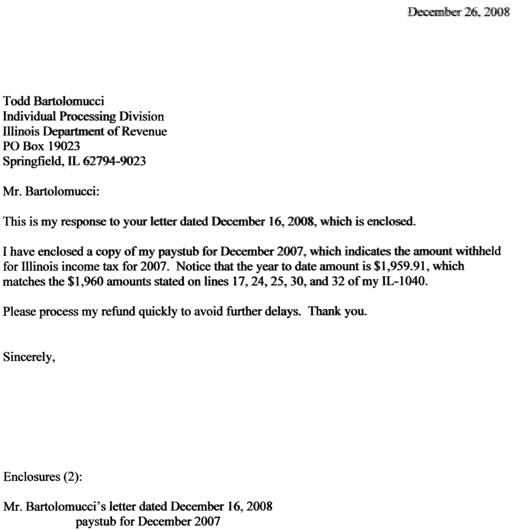

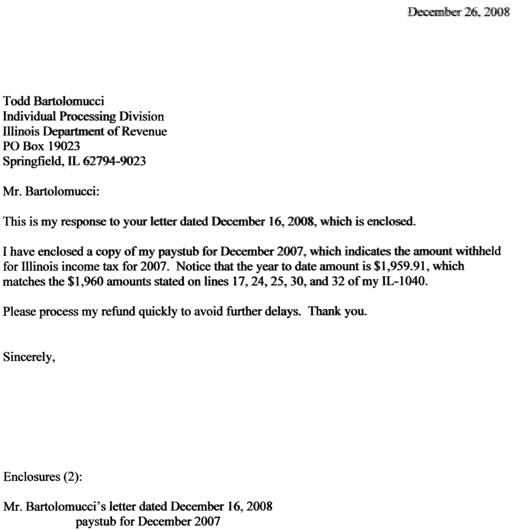

We begin with Anon.'s Illinois refund claim, filed on

March 20, 2008 (see it

here). Illinois responded on June 16 with the

following disingenuous dodge:

Note that Illinois alleges that Anon. submitted

an IL-4852, and that the problem was that the

IL-4852 wasn't substantiated as to the amount

withheld by (among other possibilities) a

federal Form 4852 (such as the one that WAS

attached to Anon.'s IL-1040).

Anon. promptly responded with Page 2 of the

notice, as requested, and both the federal form

originally submitted and an Illinois version of

the same form (after substituting "payer" on the

latter form where "employer" had inappropriately

appeared by default):

Almost a full six moths later-- it apparently

taking the state DOR that long to settle on its

next evasion-- Anon. received an acknowledgement

of his response, but with yet another demand for

more substantiation:

Keep in mind that it is a virtual certainty that

the state has complete information on the

amounts withheld from Anon. from the person that

did the withholding... Nonetheless, Anon.

played along one more time (albeit a bit

impatiently):

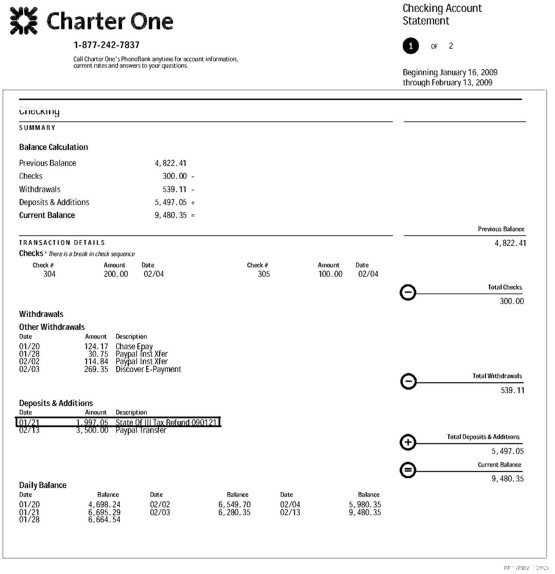

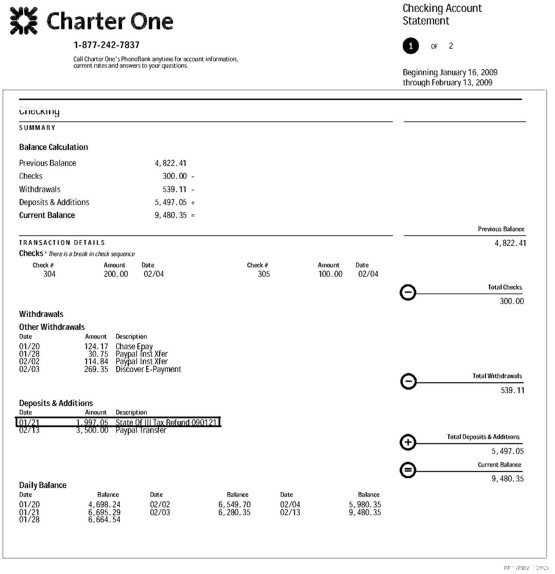

That was it-- the state had emptied its bag of

tricks. Less than a month later, Anon.'s

property was returned, with interest:

Watch out for that robot! I THINK

IT'S GOING TO EXPLODE!!

Isn't it too bad everyone hasn't done like Anon.

in Illinois, and read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help transform America. Click

here to learn how (while you still can-- see

below...).

|

|

EVERY WHICH WAY BUT

LOOSE- XV

CtC Warrior William Barnes won his fourth victory for

the rule of law only after a little tussle with the

bureaucracy in Pennsylvania...

On October 11, 2008, William had filed his educated

return, claiming a complete refund of everything that

had been withheld from his earnings and given over to

the state (see the filing

here). Annoyingly, some bureaucrat in the the

state Department of Revenue decided to act badly, and

adopted the pretense that William's claim as to the

amount withheld was unreliable (despite the virtual

certainty that the bureaucrat had corroborating

information from the withholding entity sitting on his

or her desk-- see

here and

here for more on this):

William was impatient, but untroubled. He

responded accordingly:

And, having no other pretexts for continued bad

behavior, so did Pennsylvania:

Watch out for that robot! I THINK

IT'S GOING TO EXPLODE!!

Isn't it too bad everyone hasn't done like

William, and read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help transform America. Click

here to learn how (while you still can-- see

below...).

|

|

EVERY WHICH WAY BUT

LOOSE- XIV

A Special CONTEST Episode of this

series

I want to start out by cautioning those with high

blood-pressure to have any needed medication handy, or

perhaps to simply forego this episode entirely. If

you should proceed, and it should occur to you that the

IRS employee whose work you're reading gets paid a whole

lot of money every year ($63K - $82K, plus benefits,

according to an ad for the position posted earlier this

week on newjerseyjobnetwork.com) either to deliberately

produce this drivel, or despite being incapable of

producing anything better, your health may be in

danger...

The Background

CtC Warrior Monte Reimann has already won several

victories on behalf of the rule of law.

Nonetheless, the IRS-- still struggling to evade the law

in order to continue shoveling huge gouts of American

wealth to favored cronies of the political class-- has

been attempting to dodge his filings for some older

years. Monte has been turning the rogue agency

every which way but loose...

Part of this little battle of truth and the law versus

b.s. and pretense has involved some back-and-forth with

an IRS "appeals officer". The latest missive from

this fine public servant furnishes us with both the

entertaining substance of this EWWBL episode, and the

gameboard for a fine exercise in baloney-hunting.

Here it is in all its foggy and squishy-brown glory:

|

Dear Mr. Reimann:

As you may know, I have been assigned your

case for Appeals consideration and to try to

resolve the issues before your necessity to

appear before the Tax Court. We at Appeals are

neither advocates of the Government nor you as

the taxpayer. Our job is to ascertain the facts

and apply the law and to advise both parties,

the Government and you, as to the hazards and

chances of prevailing on each issue. To that

end, I have several requests of you.

It appears that you protest the examination

determination that you are subject to income tax

on alleged wages paid to you. Due to the fact

that you filed Form 4852 and deny the taxability

of wages, but do claim the benefits of alleged

withholdings, I am confused as to your position

and request clarification.

With your filed returns, your transmittal

letter states that you rebut claims by the

issuer of Forms W-2 that the amounts disclosed

as wages under IRC Sec. §3401 (a) and §3121 (a)

are incorrect and not subject to tax. I have

numerous factions of confusion on this

statement. First, can you confirm that you did

not work for these issuers of Form W-2's or

provide me a statement that the reported

earnings are not yours by ownership? If you did

not provide any service for these issuers, would

you please be so kind as to provide me a copy of

the letter you sent them stating that the Forms

were issued in error. Or is your position simply

that they are not taxable under the cited

authority?

If the wages are in fact exempt from taxation

under the Sections you cite, which I find to be

not applicable and not the case for these

Sections, I ask you for your similar authorities

allowing you to claim the benefit of the

withheld taxes. Under the same theory, any tax

withholding would also be exempt and not

applicable. I can find no Code section that

provides for your taking benefit of these

withholdings if you claim the wages are exempt

from taxation. If fact, under your authorities

that you have cited, if the amounts are not

"wages" as you have claimed, then those payments

are also not subject to withholding. As such,

the withholding of any taxes would constitute an

error on your alleged employer's part. As an

error, you would have to present a claim to them

for the error; that would not be a matter

between you and the Internal Revenue Service.

Please present me a copy of your correspondence

that you have sent to the respective issuers of

Form W-2 requesting that they correct the Form

that they have issued, and also your request for

a refund of taxes withheld from you by them.

Upon receipt of that correspondence, we will

investigate with them as to why they have not

provided you with their response. Otherwise, I

find that any claim for refund is between you

and them and is not an issue before me.

Additionally, since you are not denying that

you received a check or monetary payment, you

certainly did not receive the total amount

listed on said Forms W-2. So unless your

received some sort of "income" or benefit on the

gross amount, I am at a loss as to your

authority to claim, what perceived to be, a

double benefit for the withheld taxes since you

did not receive that income. I would enjoy

receiving your authorities on this position.

Finally, I might agree that IRC Sec. §3401

and §3121 may not be applicable to you with

regard to the issues raised by examination and

your returns. However, I do find that IRC Sec.

§61 is inherently applicable and overrides any

consideration of IRC Sec. §3401 and §3121 with

respect to you. I request that you provide me

your authorities as to why IRC Sec. §61 is not

applicable with regard to the money you appear

to have conceded as receiving from the issuers

of Form W-2. I can find no authorities that will

override Sec. §61 and also find that your

chances of prevailing in Tax Court on this issue

to be negligible.

You have also disclosed and reported income

from a bank account as interest income, and also

cancellation of debt income. I would be

interested in receiving your authorities as to

how the amounts paid to you under the allegedly

incorrect Sec. §3041 and §3121 differ from those

amounts you have in fact declared and disclosed

under IRC Sec. §61. As far as reporting and

disclosure are required, the same authorities

that are applicable to the interest and

cancellation of debt income are also applicable

to the amounts received from the Form W-2

issuers. I find conflict in your position with

regard to this issue, and this creates another

area of hazards of litigation for you should you

proceed to trial.

Please provide me with the requested

clarification and authorities at your earliest

convenience. If I do not hear from you by April

30, 2009, I will close your Appeals

consideration of your case and forward the file

on to Area Counsel for Trial preparation. I look

forward to hearing from you soon.

Sincerely,

Michael Chambers

Appeals Officer

|

The Contest

In a word: Take this

nonsense apart!

This "letter" is riddled

with a mind-boggling array of misstatements,

mischaracterizations and pretenses of misunderstanding.

It could be described as an 876-word fallacy, or a

demonstration of the extremes to which the spouting of

non sequiturs can be taken by a practiced master of that

sordid little art. Your job as a contestant is to

parse out each fallacious nugget and briefly explain its

failings.

The acceptable format for

an entry in the contest will be that of a reply to this

farcical nonsense, but within that general format, you

have complete latitude. You can do bullet-points,

insertions, or whatever else suits your fancy, as long

as the entry is comprehensible and presentable.

The prize for the winning

entry-- which will be judged on thoroughness of

parsing/debunking and presentability-- is a beautiful 'I

Cracked the Code' T-shirt!

You've only got ten days

to tear this thing up, Warriors, so start your

computers!

Send your entries to me

at survey 'at' losthorizons.com, as a .doc, .rtf, .txt

or .htm file, please I can convert some WordPerfect

files, but without complete reliability, so these should

be avoided.

And The Winner Is...

Justin Laue, with the following cogent,

scholarly and calm rebuttal of Michael Chambers'

incoherence (which I think Justin saw as a

product of low capacity rather than outright bad

faith...):

|

Dear Mr. Chambers,

Thank you for the opportunity to present

the facts of this case; hopefully we can

come to a swift

resolution. To that end, I am herein

providing answers to your various

questions.

First of all, it is a bit difficult to

clearly ascertain what your specific

questions are as you make several

contradictions and misstatements. “Due

to the fact that you… deny the

taxability of wages”, “wages are

in fact exempt from taxation” are

examples of statements that you

attribute to me that I have not made

and are not true, but then you correctly

state that I claimed the “amounts [paid

to me] are not “wages””

as defined in IRC Sec. 3401(a) and

3121(a). On this latter statement, you

seem to agree, and, regardless, is

established fact as I am the one with

personal knowledge and testified to this

on my return.

In your letter, you asked me to “confirm

that [I] did not work for these issuers

of Form W-2’s or provide

[you] a statement that the reported

earnings are not [mine] by ownership.”

However, as I am sure you

are aware, the Form W-2 is not for

reporting “work” or “earnings” but

rather “wages” paid from an

“employer” to an “employee”, and that,

in fact, any private-sector exchange of

work and/or earnings

between me and anyone else is beyond the

scope of this case.

You then state that, as I had received

no “wages” then the issuer of the Form

W-2s had no business

submitting withholdings to the IRS on my

behalf and that it should then be a

matter between myself and

that issuer. In general, I might agree,

however the law provides that these

amounts are to be treated as

“overpayments” (see IRC Sec. 6401, 6402

and 31(a)(1)). In fact, the law

specifically states, “An amount

paid as tax shall not be considered not

to constitute an overpayment solely by

reason of the fact that

there was no tax liability in respect of

which such amount was paid.” (Sec.

6401(c))

I am at a loss to understand the

question you put forth in your fifth

paragraph. Simply put, I am to be

credited with the “overpayment”

irrespective of any liability I

eventually had, and thus also,

irrespective

of any “income” I may, or may not, have

received. I am not seeking benefit of

any sort; I only seek to

recover property incorrectly diverted to

the IRS as accorded me by law.

Regarding IRC Sec 61, it would suffice

to show what it cannot mean: the Supreme

Court has repeatedly

stated that the income tax is not and

cannot be an unapportioned direct tax

(see United States Supreme

Court, Brushaber v. Union Pacific R.

Co., 240 U.S. 1 (1916), Stanton v.

Baltic Mining Co., 240 U.S. 103

(1916), and Peck v. Lowe, 247 U.S. 165

(1918)) such that “the income tax is,

therefore, not a tax on

income as such. It is an excise tax with

respect to certain activities and

privileges which is measured by

reference to the income which they

produce. The income is not the subject

of the tax: it is the basis for

determining the amount of tax”

(Congressional Record, Proceedings and

Debates of the 78th Congress,

March 2, 1943, to April 5, 1943).

It can be clearly shown that congress

has never meant for the income tax to be

a direct tax. Sec. 61 is

derived from The Revenue Act of 1928

which had the benefit of The

Classification Act of 1923. The first

item listed in Sec. 61 is “Compensation

for services”. When the meanings of the

terms “Compensation”

and “services” (as well as, then,

“position” and “employee”) are

substituted from the classification act,

“Compensation for services” has

virtually identical meaning to “wages”

as defined in IRC Sec. 3401(a)

and 3121(a). Thus, under the principle

of ejusdem generis (see United States

Supreme Court, Circuit City

Stores v. Adams, 532 US 105, 114-115

(2001) and Norfolk & Western R. Co. v.

Train Dispatchers, 499 US

117 (1991)), the following items in Sec.

61 would likewise be inherently

restricted to sources of income

derived from federal privilege (and

thus, an excise tax, not a direct tax).

As to the items of income I declared on

my return, I had received Form 1099s

from the persons or

entities making those payments (I

included these Form 1099s with my

return). According to the

directions for the use of Form 1099,

this form is only to be used by a “Trade

or Business” (i.e.

“performing the functions of public

office”, IRC Sec. 7701(26)). Therefore,

in submitting the Form 1099s,

these persons or entities were declaring

under oath that they are performing the

functions of public

office. As I have little or no personal

knowledge of the nature these persons or

entities, I must take this

testimony at face value. These payments

would clearly then be within the meaning

of Sec. 61. If I come

to find that these forms were also

incorrectly used, and that these persons

or entities are not to be

considered a “Trade or Business,” I will

surely be submitting an amended return

to correct this.

I hope these answers expand your

understanding of the case. If necessary,

I could go into much greater

depth in support of each of my answers

but in the interest of clarity I tried

to make them brief.

Sincerely,

|

CONGRATULATIONS, JUSTIN!!

Watch out for that robot! I THINK

IT'S GOING TO EXPLODE!!

***

Isn't it too bad everyone hasn't done like Monte

and Justin, and read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help transform America. Click

here to learn how (while you still can-- see

below...).

|

|

EVERY WHICH WAY BUT

LOOSE- XIII

I'm pleased to be able to share a great little story

this week, the beginning of which I had learned back in

2007, but the end of which hadn't been passed along to

me until just a few months ago.

A CtC-educated filer who has unfortunately chosen to

remain anonymous had routinely secured a complete refund

of everything withheld from him and given over to the

federal government in connection with the "income" tax

scheme during 2005:

However, a little over a year later, some designated

"disinformation/discouragement officer" at the IRS

decided to take a shot at blustering and bullsh*tting

Anon. back into the pen and onto his knees:

I haven't seen the return filed by Anon. for this year,

and he may well have made the mistake of listing FICA

"income" tax withholdings as "excess social security tax

withheld" per the misunderstanding about the purpose of

that line on a 1040

discussed here. However, as Anon. very

cogently points out in his response to this disingenuous

agency effort, that issue is entirely moot at this

point:

The D/D officer wasn't ready to give up, though. A

few months later, Anon. got THIS in the mail:

(Math skills don't appear to be part of the D/D officer

job description...)

Anon., doubtless sighing in exasperation at the apparent

need to say everything twice to scoundrels trying to run

a scam and not willing to take the first "NO!" for an

answer (perhaps in the hope that it was just a fluke or

an extended typo), repeated himself (and much more

politely than some would have done, under the

circumstances):

This time the D/D office got the message: this is a

CtC-educated American, who therefore knows the truth and

has a proper, unbending respect for the rule of law and

his own rights and civic responsibilities. No

doubt with a sigh of his own, the law-defier behind this

sleazy effort abandoned it as a bad business.

It shouldn't ever have been begun, of course, but if the

agency took THAT attitude, a whole lot of its 122,000

workers wouldn't have anything to justify their very

considerable remuneration, and would lose their jobs,

and THEN where would the economy be? But wait!

They could now all be put to work at public expense

building wind turbines or other such items that somehow

the market doesn't find to be worth building

voluntarily! Maybe THAT'S what Obama's new "New

Deal" is really all about...

Watch out for that robot! I THINK

IT'S GOING TO EXPLODE!!

Isn't it too bad everyone hasn't done like

Anon., and read

CtC-- the exclusive source of the complete,

accurate and liberating truth about the "income"

tax? You can help change that, and thereby

help transform America. Click

here to learn how (while you still can-- see

below...).

|

Every Which Way But Loose I

Every Which Way But Loose III

Also, see the

Victories Highlights page for additional specially-notable

CtC-educated victories, and, to enjoy hundreds and hundreds

of straightforward "just-the-check-and-no-hassles" victories enjoyed

by the CtC-educated for years now,

click here.

|

Are You Ready For

More Power?

"Peter Hendrickson has done it again! 'Upholding

The Law' does for individual liberties what 'Cracking

the Code' did for tax law compliance: exposes the

reader to the unalienable truth!"

-Jesse Herron, Bill Of Rights Press, Fort Collins,

Colorado

AND DON'T MISS

NEW

from Pete Hendrickson,

the man who Cracked the Code of the United States

"income" tax;

became the first American in history to recover

EVERYTHING withheld from him, Social Security and

Medicare "contributions" included;

and has ever since been the target of unrelenting

assaults by a government willing to do just about

anything to thwart the spread of the truth!!

In this new volume, you'll learn about:

|

Plus,

...and much, much more!

|

|

|

Is this information of any value to you? If so,

please consider a donation to help keep it available.

Donations can be sent to:

Peter Hendrickson

232 Oriole St.

Commerce Twp., MI 48382

|

|