|

More Victories For The Rule Of Law- Page Forty-Eight

Tens of thousands of readers of 'Cracking the Code- The Fascinating Truth About Taxation In America' have taken control of their own resources, in accordance with, and respect for, the law. The likely total amount reclaimed by these good Americans so far is upward of several billion dollars. A few of these good American men and women-- such as those honored below-- are generous enough to send me the evidence of their victories in upholding the law, for the edification and inspiration of everyone. At the moment those shared refund checks, closing notices, and so forth total:

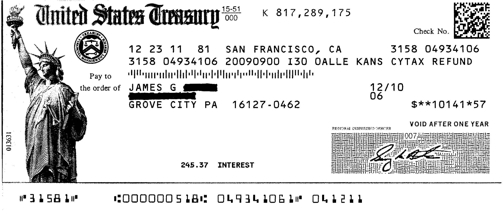

James G.

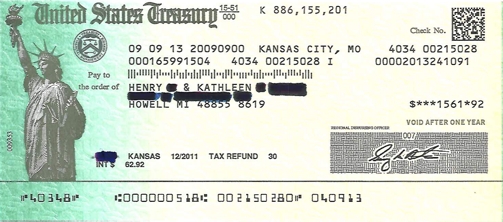

Travis and Angie Scott

This August 16, 2013 victory was on an amended return-- see it here.

Click here to see the amended filing that produced this complete refund with interest.

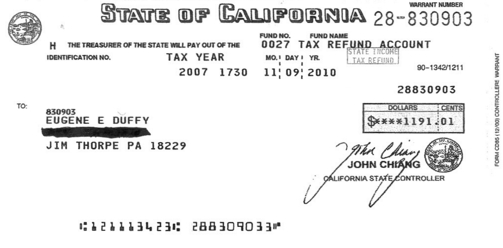

Eugene Duffy

This complete refund (with interest) is a result of an amended filing (really, a replacement filing with explanation). See the docs here.

Anon.

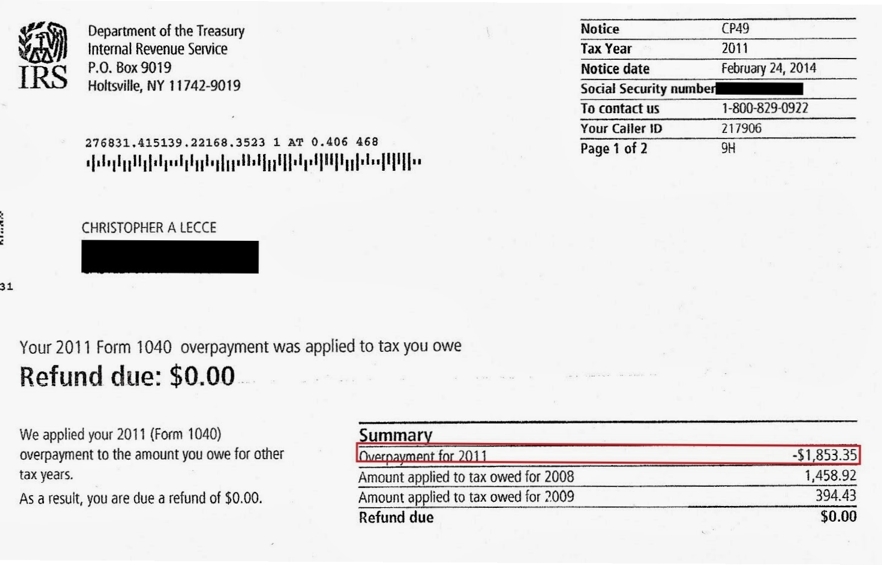

Note the overpayment acknowledgement in the "Summary", and see the filed docs that led to this refund credit here.

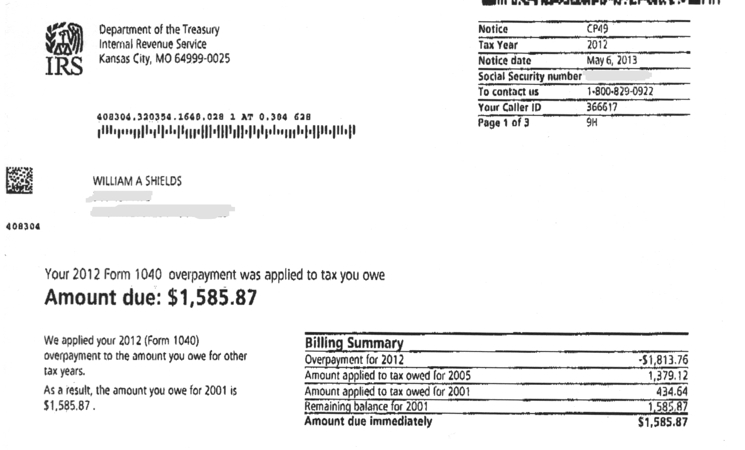

Willie Shields

Don't be misled-- while what the IRS alleges to be owed for a different year is made the most prominent feature of this notice, it is, in fact, a notification that Willie has been refunded everything withheld from him during 2012 (which was all Social Security and Medicare taxes). See the "Billing Summary" section. The amount has simply been gratuitously diverted to pay off what the government alleges to be outstanding balances for other years.

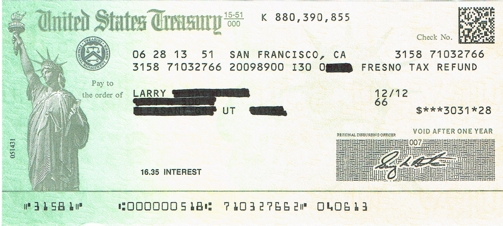

Larry _

See the docs that produced this partial victory here (and a related FAQ here).

Holiday Chock

See the docs that produced Holiday's debut victory for the rule of law here.

William & Caroline Wadsworth

William and Caroline Wadsworth filed a CtC-educated return concerning 2011 acknowledging some "income" and rebutting a half-dozen individual erroneous allegations by payers that other of their receipts also qualified as "income". Over a year later the IRS decided to try to chivvy them back into the "ignorance barn" with the livestock:

But these two American heroes refuse to be cowed by domestic enemies of the law. They stood their ground and were rewarded for their perseverance with this crisp and clear acknowledgment of the truth about the tax as revealed in CtC:

See the whole story, with all the docs involved, here.

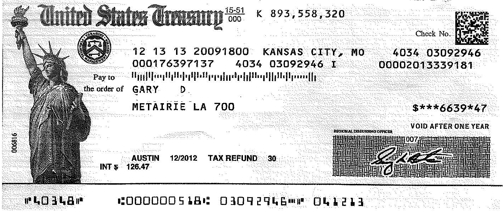

Gary D.

See the amended filing that produced this refund here.

Here's Gary's LA refund for the same year, 2012:

The cover letter for the filing which yielded this victory can be seen here.

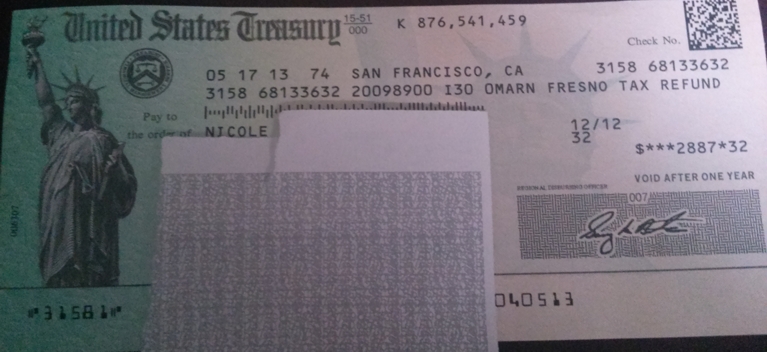

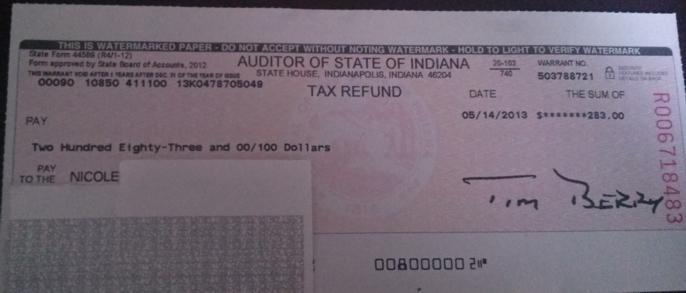

Nicole

Todd Ryan

Don't be misled-- while what the IRS alleges to be owed for a different year is made the most prominent feature of this notice, it is, in fact, a notification that Todd has been refunded everything withheld from him during 2012 (which was all Social Security and Medicare taxes). See the "Billing Summary" section. The amount has simply been gratuitously diverted to pay off what the government alleges to be outstanding balances for other years.

The filing that produced this victory can be seen at the link above; Todd's previous victories are posted elsewhere on these pages.

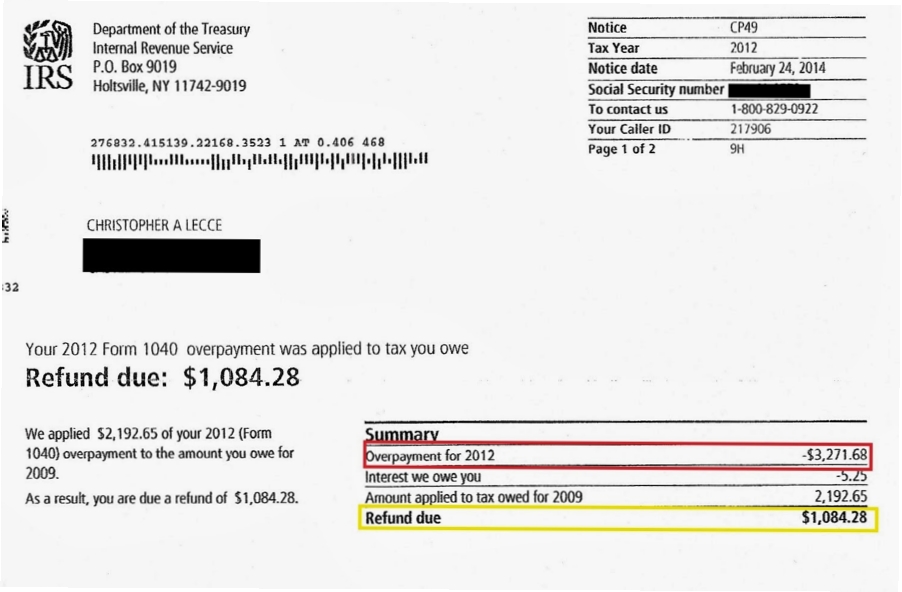

Chris and Marta Lecce

(a) Status.- Amtrak- (3) is not a department, agency, or instrumentality of the United States Government...

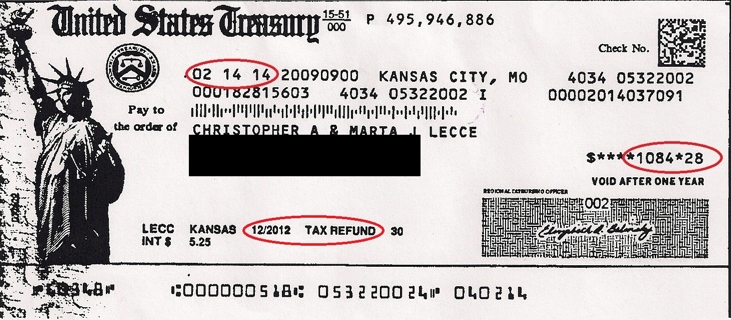

Mark Lovely

There's a big story associated with this fourth posted victory for Mark; see page 1 of the Every Which Way But Loose collection for the details.

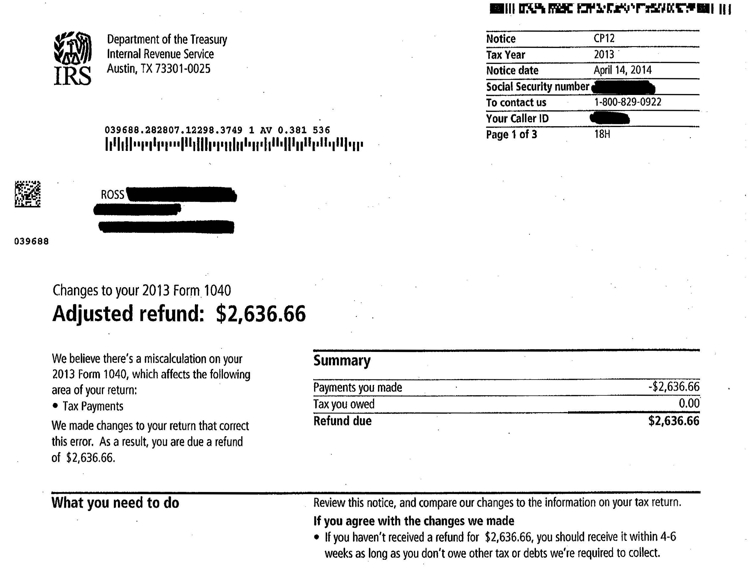

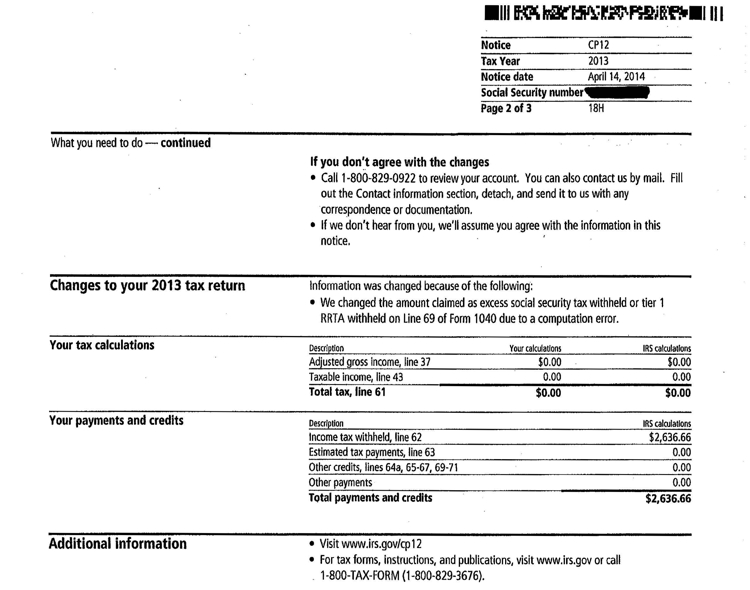

Ross

There IS a modest glitch in this victory-- Ross made the mistake discussed here. The government appears to have chosen to exploit the error by hanging on to Ross's Social security and Medicare withholdings for the moment, even while agreeing that Ross didn't engage in the activity that cause such taxes to arise. I'm sure that'll be dealt with in due course, such as took place in this very similar incident from a few years ago. See the docs Ross filed (and his prompt response to the government's shabby ploy) here.

Nathan and Lynda Cooley

There's a story behind this one-- see it here.

Click here to return to the Bulletin Board

Even in the face of the requirements of the law, the junkyard dog still tries to play its losing hand occasionally. Ironically, it is these sporadic spasms of resistance that offer the most telling evidence of the truth about the tax...

Despite the fact that those whose victories are on display here did nothing but insist that the law be applied as it is written, they did so in the face of fearful threats and cunning disinformation from the beneficiaries of corruption. Their actions took great courage and commitment, and I salute them all.

“God grants liberty only to those who love it, and are always ready to guard and defend it.”

-Daniel Webster

NOTE: Whether any given individual is entitled to a refund depends on a number of different factors, and no one should presume that they are so entitled simply because they see that others are. Each person should educate himself or herself about the particulars of the law, and make his or her own determination in this regard. |

To get on the Lost Horizons mailing list, send an email to SubscribeMe 'at' losthorizons.com with your name in the message field.

An "Income" Tax Subject Site Map

NOTE: The documents displayed on this and any linked pages, and any associated comments, are posted with the permission and cooperation of the upstanding Americans with whom they are concerned.

When a return is posted in connection with any refund or other responsive document, it is complete-- that is, what is posted is EVERYTHING filed as a return in connection with that refund or document, unless otherwise indicated.