|

More Victories For The Rule Of Law- Page Sixty-One

Tens of thousands of readers of 'Cracking the Code- The Fascinating Truth About Taxation In America' have taken control of their own resources, in accordance with, and respect for, the law. The likely total amount reclaimed by these good Americans so far is upward of several billion dollars.

A few of these good American men and women-- such as those honored below-- are generous enough to send me the evidence of their victories in upholding the law, for the edification and inspiration of everyone. At the moment those shared refund checks, closing notices, and so forth total:

James Graham On May 11, 2018, the United States respectfully return all the money that had been withheld from James during 2017 against the possibility that any of his economic activities would prove to have been of the excise-taxable variety:

Here is the return by which this American titan of liberty and the rule of law secured the complete refund shown above, which was issued after the usual vetting and a little more, besides. Justin Gilmore & Brianna Osnain Colorado has returned everything it had expected to keep of the recompense hard-earned by Justin and Brianna during 2017, but to which it had no lawful claim whatever:

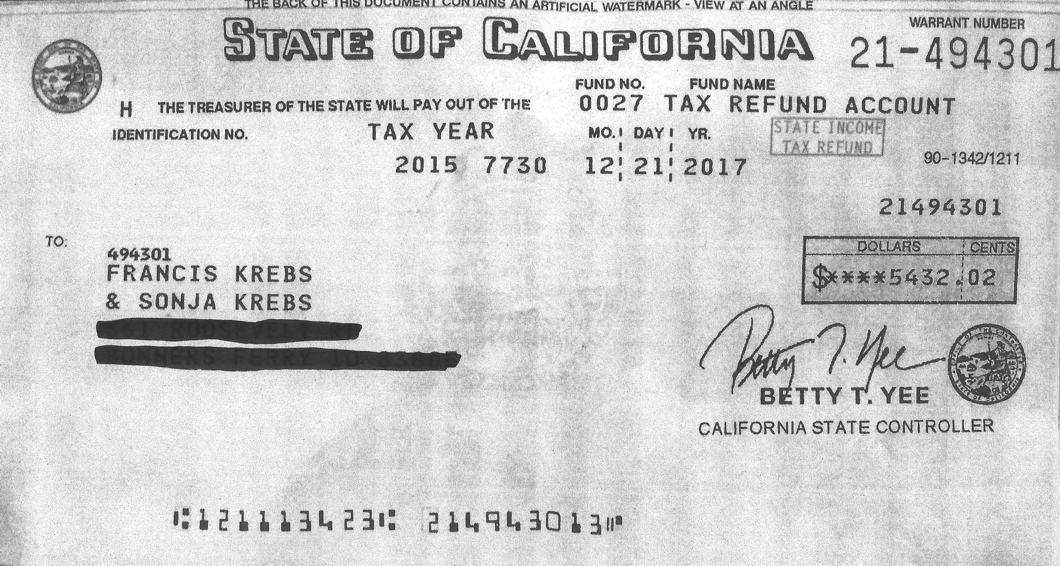

Here is the return by which these American titans helped Colorado avoid the sin of exploiting myths about the tax. Francis & Sonja Krebs California has returned every penny of this good couple's property that had been withheld from them during 2015 and given to the state, plus interest:

California would have kept this money for itself without batting an eye had titans Francis and Sonja not learned the truth about the income tax and had the courage to insist that the law be upheld, by way of this filing. James Wright James has recovered every penny withheld from what was owed to him and given over to the United States instead:

Here is the return by which James secured this complete refund, and it's just a pity that he didn't know the truth about the tax back in 2008 and 2010. Kevin & Nilka Angeles Kevin and Nilka have received a refund-in-progress of more than the total of what was withheld as nominal federal income tax. Or, it's more still than the total of what was withheld as FICA surtaxes. But it's not yet quite the total of both combined, even though what WAS returned is more than enough to constitute an admission that the couple did nothing during 2017 that qualified for either class of income taxes. Here is the check:

And here is the filing that produced this attenuated-without-explanation refund. We'll trust that the other $2732.45 will arrive in due course, or an explanation of its diversion will be forthcoming (or will be secured on demand...). Matt & Katie Here is the refund check Matt and Katie received last month:

Here is the overpayment acknowledgement:

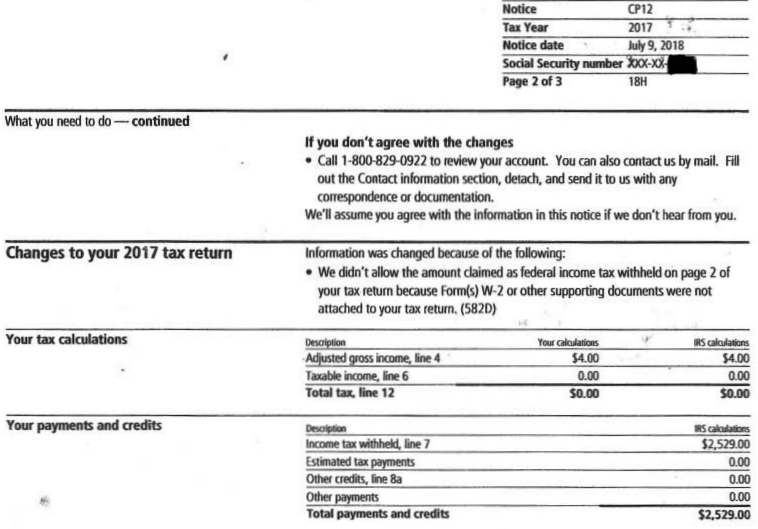

Here is the government admission that Matt and Katie received no tax-related income during 2017 and owe no tax in connection with that year

And here is the filing, by which it will be seen that the shameless IRS ploy being attempted here is to simply lie. The agency pretends to only know about $2,529.00 having been withheld from Matt and Katie, when the actual amount, as reported under oath by Matt and Katie, and doubtless as corroborated by the creators of the W-2s that are rebutted as to only their allegations of statutorily-defined "wag" receipts by Matt and Katie's Forms 4852, is $5,673.51. But Uncle Sammy want to keep something, by hook or by crook... Well done, Matt, and well done, Katie!! But, Watch out for that robot! I think it's going to explode!!

Jordan J. 2016

Docs from the filing that produced this complete refund (in two parts-- one from an original return and the remainder after an amended return correcting an error) haven't yet been sent. 2017

As you can imagine, there is a story behind this notice, and it's a doozy. Find it here. Michael Gonzalez

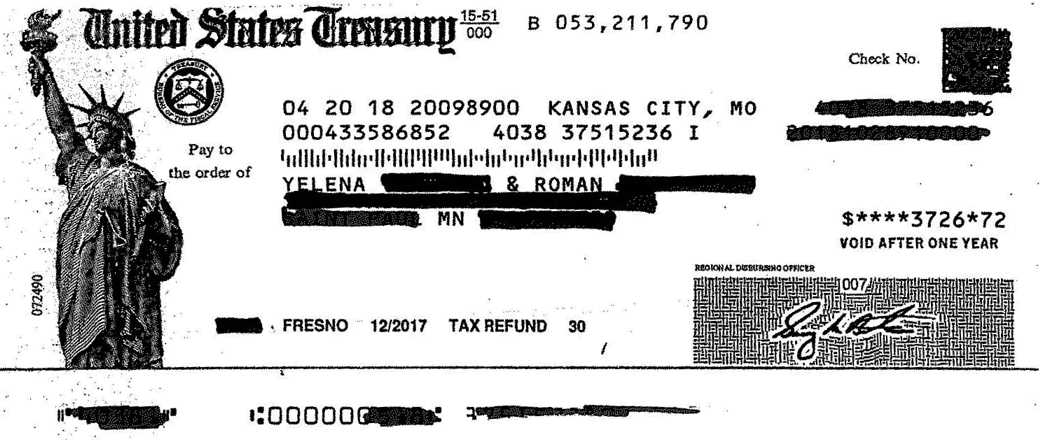

Docs of the filing are not yet available for posting. Yelena & Roman

Here is the filing that produced this complete federal refund (which is actually of $4,170.94, as you'll see explained in the filing). It's a slightly out-of-the-ordinary victory in that Yelena and Roman have both federally-connected and non-federally-connected earnings.

Here is the Minnesota filing that produced THIS complete refund. Dan & Jane Moore

This nice refund complements Dan & Jane's federal refund for 2017, secured earlier this year. Here is the filing submitted to the state. After that filing went in there was a bit of balking by Virginia which was well-answered. This exchange was followed by the state's complete capitulation to the "Hendrickson scheme" last week. Carmen Parks HERE IS CARMEN'S MOST RECENT victory on behalf of the rule of law-- a complete federal refund of what was withheld from her in 2015, after an IRS pretense of not having received her return back in 2016 and the re-filing of the same return two years later:

No interest paid on this belated refund, based, no doubt on the argument that the claim was only filed this past July... Here is Carmen's return (note the date) and here is her husband Ray's note explaining this unusual sequence of events. Ken & Joyce Wells KEN & JOYCE HAVE ALSO JUST RECEIVED A 2015 REFUND-- this one from the state of Oregon:

This refund DOES have interest included, since the state does not dispute its responsibility for the delay:

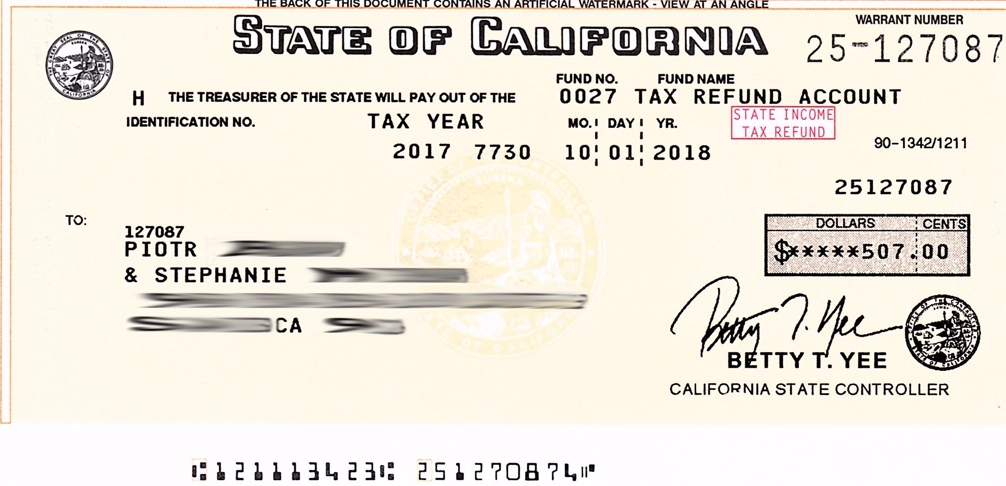

Unfortunately, though prompt in sending the scans above, Ken and Joyce have not yet sent scans of the associated docs (please, everyone-- read and take very seriously the posts at this link!). Piotr & Stephanie PIOTR & STEPHANIE SHARE TWO VICTORIES this week-- complete refunds from California and the feds of everything withheld in 2017:

Most of Piotr & Stephanie's economic activity involves credit-card transactions in which no withholding takes place, but meaning that part of their filing comprises rebuttal of a 1099-K, something we've not seen much of so far, and in which some other might take an interest. See the California filing here, and the federal filing here. Derek Cushman DEREK'S LATEST VICTORY IS A COMPLETE REFUND of everything withheld from him and given to the feds in 2017-- nearly every penny of which is withheld as Social Security and Medicare tax:

Derek's federal victory for 2017 also includes interest, because the feds spent a bit of time verifying Derek's claim with this identity challenge before issuing the complete refund.

Click here to return to the Bulletin Board

Even in the face of the requirements of the law, the junkyard dog still tries to play its losing hand occasionally. Ironically, it is these sporadic spasms of resistance that offer the most telling evidence of the truth about the tax...

Despite the fact that those whose victories are on display here did nothing but insist that the law be applied as it is written, they did so in the face of fearful threats and cunning disinformation from the beneficiaries of corruption. Their actions took great courage and commitment, and I salute them all.

“God grants liberty only to those who love it, and are always ready to guard and defend it.”

-Daniel Webster

NOTE: Whether any given individual is entitled to a refund depends on a number of different factors, and no one should presume that they are so entitled simply because they see that others are. Each person should educate himself or herself about the particulars of the law, and make his or her own determination in this regard.

To get on the Lost Horizons mailing list, send an email to SubscribeMe 'at' losthorizons.com with your name in the message field.

NOTE: The documents displayed on this and any linked pages, and any associated comments, are posted with the permission and cooperation of the upstanding Americans with whom they are concerned. When a return is posted in connection with any refund or other responsive document, it is complete-- that is, what is posted is EVERYTHING filed as a return in connection with that refund or document, unless otherwise indicated. |